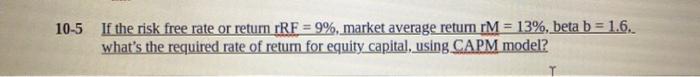

Question: 10-5 If the risk free rate or return rRF = 9%, market average retum M = 13%, beta b= 1.6. what's the required rate of

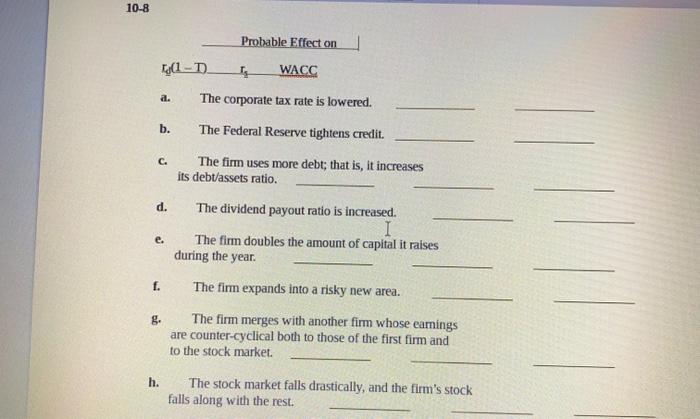

10-5 If the risk free rate or return rRF = 9%, market average retum M = 13%, beta b= 1.6. what's the required rate of return for equity capital, using CAPM model? 10-8 Probable Effect on Id(1-1). TE WACC a. The corporate tax rate is lowered. b. The Federal Reserve tightens credit. C. The firm uses more debt; that is, it increases its debt/assets ratio. d. e. The dividend payout ratio is increased. I The firm doubles the amount of capital it raises during the year. The fim expands into a risky new area. 1. g. The firm merges with another firm whose earnings are counter-cyclical both to those of the first firm and to the stock market h. The stock market falls drastically, and the firm's stock falls along with the rest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts