Question: 10-5 If the risk free rate or return rRF = 9%, market average return rM = 13%, beta b = 1.6, what's the required rate

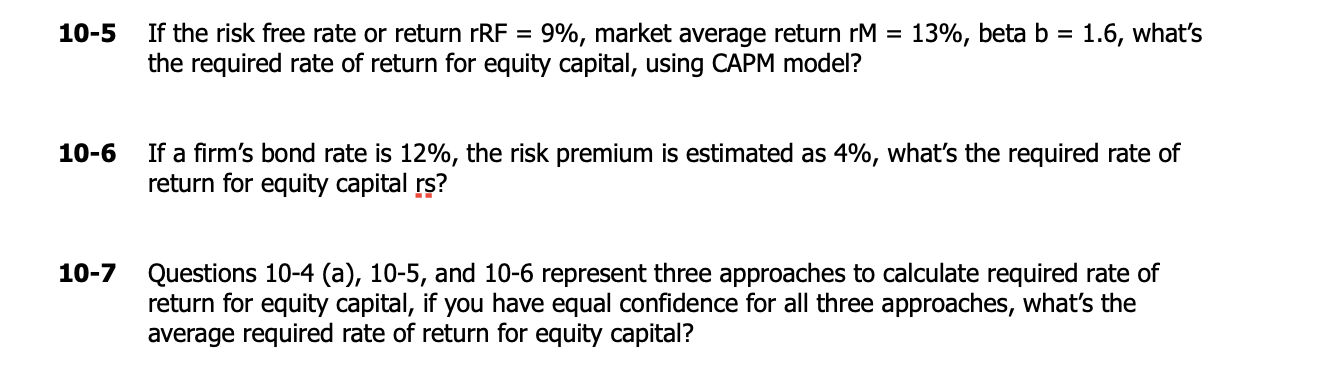

10-5 If the risk free rate or return rRF = 9%, market average return rM = 13%, beta b = 1.6, what's the required rate of return for equity capital, using CAPM model? 10-6 If a firm's bond rate is 12%, the risk premium is estimated as 4%, what's the required rate of return for equity capital rs? 10-7 Questions 10-4 (a), 10-5, and 10-6 represent three approaches to calculate required rate of return for equity capital, if you have equal confidence for all three approaches, what's the average required rate of return for equity capital

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock