Question: 12. You are considering two mutually exclusive projects. Project A has cash flows of-$125,000, $51,400, S52,900, and $63,300 for Years 0 to 3, respectively. Project

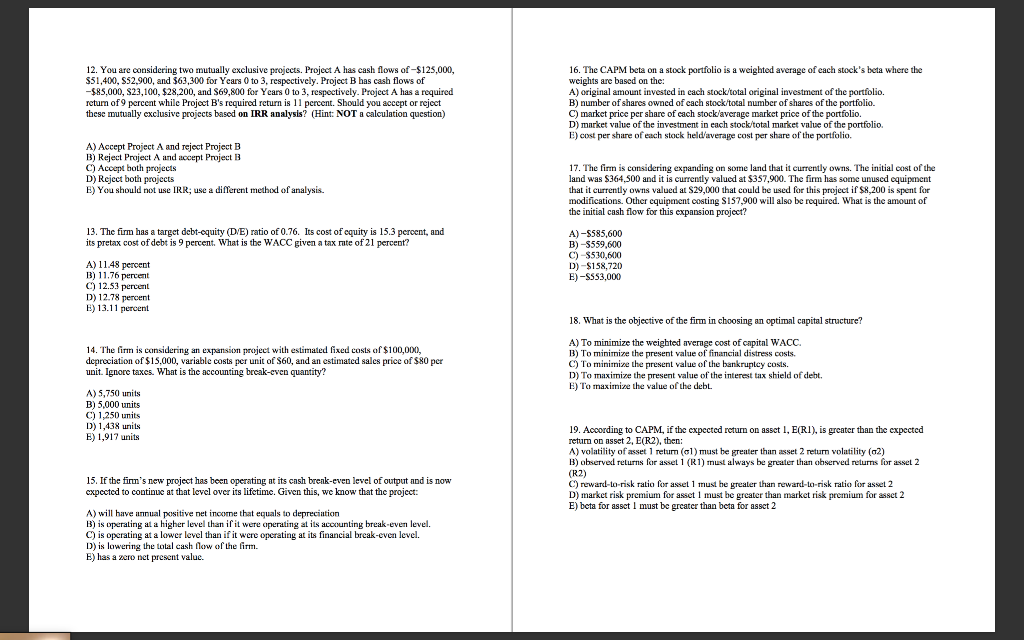

12. You are considering two mutually exclusive projects. Project A has cash flows of-$125,000, $51,400, S52,900, and $63,300 for Years 0 to 3, respectively. Project B has cash flows of -$85.000, S23,100, $28,200, and 869,800 for Years 0 to 3, respectively. Project A has a required retum of 9 percent while Project B's required return is 11 percent. Should you accept or reject these mutually exclusive projects based on IRR analysis? (Hint: NOT a calculation question) 16. The CAPM beta on a stock portfolio is a weighted average of each stock's beta where the weights are based on the A) original amount invested in each stock/total original investment of the portfolio. B) number of shares owned of each stock/total number of shares of the portfolio C) market price per share of each stock/average market price of the portfolio. D) market value of the investment in each stock/total market value of the portfolio E) cost per share of each stock held average cost per share of the portfolio. A) Accept Project A and reject Project B 1) Reject Project A and accept Project 1 C) Accept both projects D) Reject both projects E) You should not use IRR; use a different method of analysis. 17. The firm is considering expanding on some land that it currently owns. The initial cost of the land was $364,500 and it is currently valued at $357,900. The firm has some unused equipment that it currently owns valued at $29,000 that could be used for this project if $8,200 is spent for modifications. Other equipment costing S157,900 will also be required. What is the amount of the initial cash flow for this expansion project? A)-5585,600 B)-559,600 C) $530,600 D) -$158,720 E)-SS53,000 13. The firm has a target debt-equity (D/E) ratio of 0.76. Its cost of equity is 15.3 percent, and its pretax cost of debt is 9 percent. What is the WACC given a tax rate of 21 percent? A) 11.48 percent B) 11.76 percent C) 12.53 percent D) 12.78 percent E) 13.11 percent 18. What is the objective of the finn in choosing an optimal capital structure? A) To minimize the weighted average cost of capital WACC. B) To minimize the present value of financial distress costs. C) To minimize the present value of the bankruptcy costs. D) To maximize the present value of the interest tax shield of debt. E) To maximize the value of the debt. 14. The firm is considering an expansion project with estimated fixed costs of $100,000, depreciation of $15.000, variable costs per unit of $60, and an estimated sales price of $80 per unit. Ignore taxes. What is the accounting break-even quantity? A) 5,750 units B) 5,000 units C) 1,250 units D) 1,438 units E) 1,917 units 19. According to CAPM, if the expected return on assct 1, E(RI), is greater than the expected retum on asset 2, E(R2), then: A) volatility of asset 1 retum (Gl) must be greater than asset 2 return volatility (62) ) observed returns for asset i (R1) must always be greater than observed returns for asset 2 (R2) C) reward-to-risk ratio for asset 1 must he greater than reward-to-risk ratio for asset 2 D) market risk premium for asset 1 must be greater than market risk premium for assct 2 E) beta for asset I must be greater than beta for asset 2 15. If the finn's new project has been operating at its cash break-even level of output and is now cxpected to continue at that level over its lifetime. Given this, we know that the project: A) will have annual positive net income that equals to depreciation 1) is operating at a higher level than if it were operating at its accounting break-even level. C) is operating at a lower level than if it were operating at its financial break-even level. D) is lowering the total cash flow of the firm. E) has a zero net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts