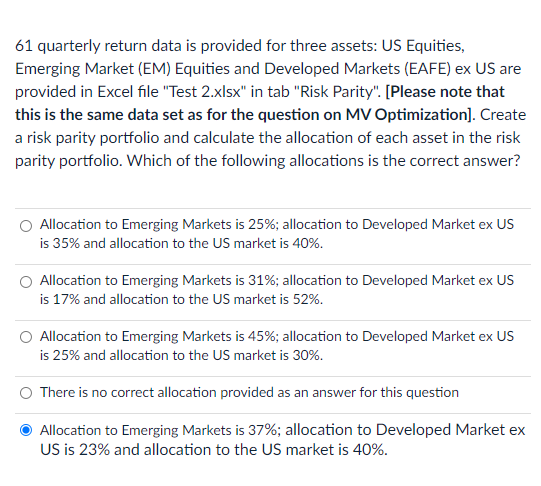

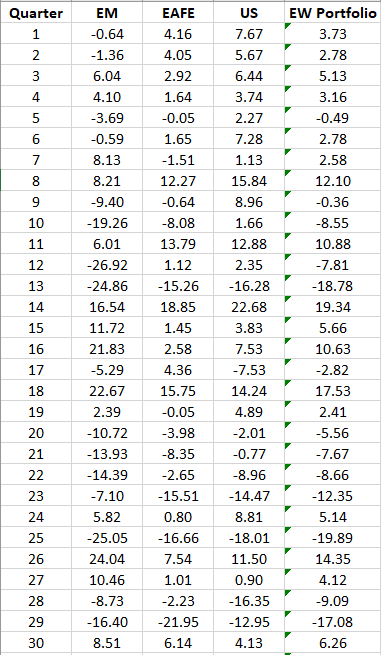

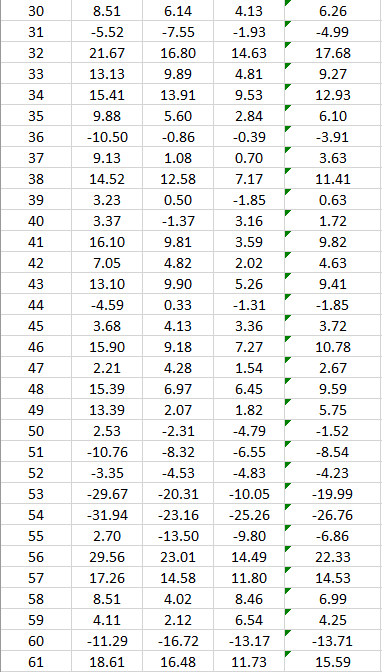

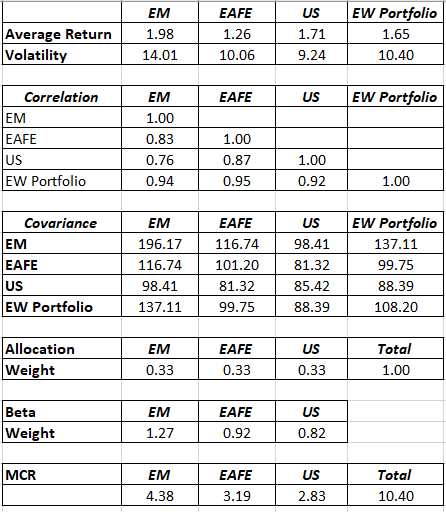

Question: 61 quarterlv return data is provided for three assets: US Equities, Emerging Market {EM} Equities and Developed Markets [EAFE] ex US are provided in Excel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock