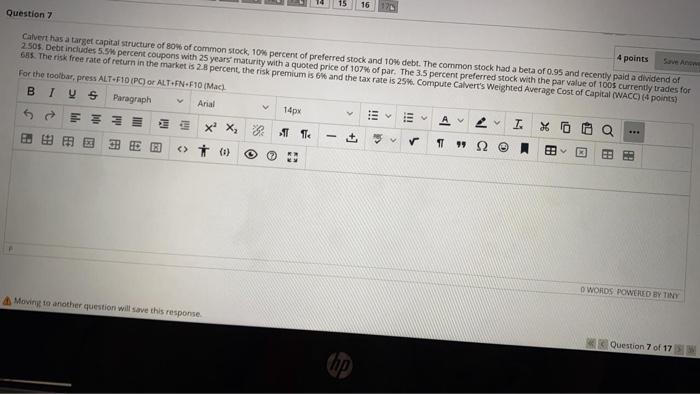

Question: 16 Question 4 points Calvert has a target capital structure of 80% of common stock, 10% percent of preferred stock and 10% debt. The common

16 Question 4 points Calvert has a target capital structure of 80% of common stock, 10% percent of preferred stock and 10% debt. The common stock had a beta of 0.95 and recently paid a dividend of 2505 Debt includes 5.5 percent coupons with 25 years' maturity with a quoted price of 107% of par. The 3.5 percent preferred stock with the par value of 100s currently trades for 685. The risk free rate of return in the market is 2.8 percent, the risk premium is 6% and the tax rate is 254. Compute Calvert's Weighted Average cost of Capital (WACC) 4 points) For the toolbar, press ALT-F10 IPC) or ALT-FN-F10 (Mac) B IS Paragraph Arial 14px A2 T. FE 3 X X 3 The 1 91 92 e ERE (1) WORDS POWERED BY TINY A Moving to another question will save this response Question 7 of 17 (hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts