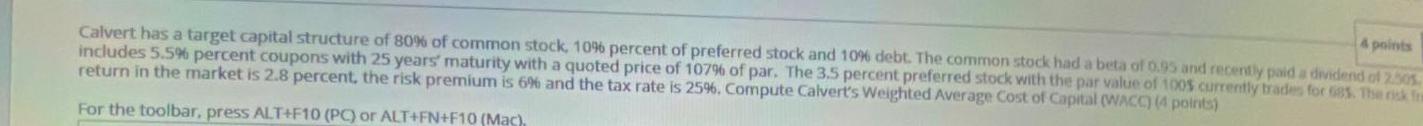

Question: Please solve quickly 4 points Calvert has a target capital structure of 80% of common stock, 10% percent of preferred stock and 10% debt. The

Please

solve quickly

4 points Calvert has a target capital structure of 80% of common stock, 10% percent of preferred stock and 10% debt. The common stock had a beta of 0.95 and recently paid a dividend of 25305 includes 5.5% percent coupons with 25 years' maturity with a quoted price of 1079 of par. The 3.5 percent preferred stock with the par value of 1005 currently traders for the return in the market is 2.8 percent, the risk premium is 6% and the tax rate is 25%. Compute Calvert's Weighted Average Cost of Capital (WAC) (4 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts