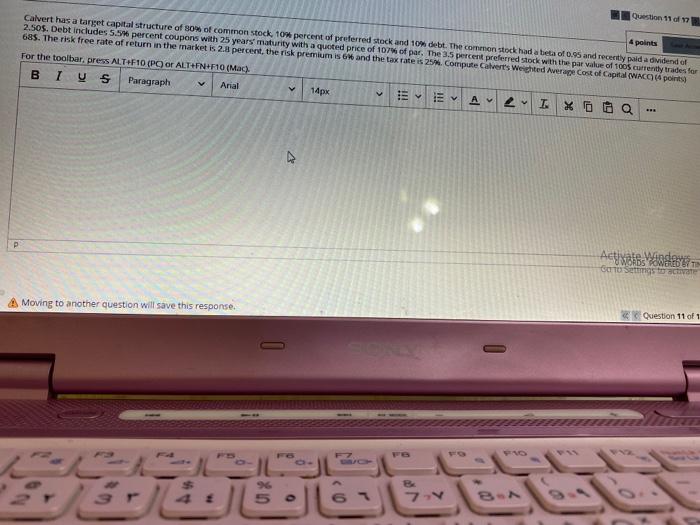

Question: Question 11 4 points Calvert has a target capital structure of 80% of common stock, 100 percent of preferred stock and 10% debt. The common

Question 11 4 points Calvert has a target capital structure of 80% of common stock, 100 percent of preferred stock and 10% debt. The common stock had a bea of 0.95 and recently paid a dividend of 2.505. Debt includes 5.5 percent coupons with 25 years maturity with a quoted price of 107 of par. The 3.5 percent preferred stock with the par value of 1005 currently trades for 685. The risk free rate of return in the market is 2.8 percent, the risk premium is GH and the tax rate is 25. Compute Calvert's Welchted Average cost of Capital (Wacopoint For the toolbar.press ALT+F10 (PO Or ALT+FN+F10 (Mac) B IVS Paragraph Arial 14px v A2 T. X QQ y >> V P Windows POWERED BY THE Go To Sets to active A Moving to another question will save this response. Question 11 of 1 5 : O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts