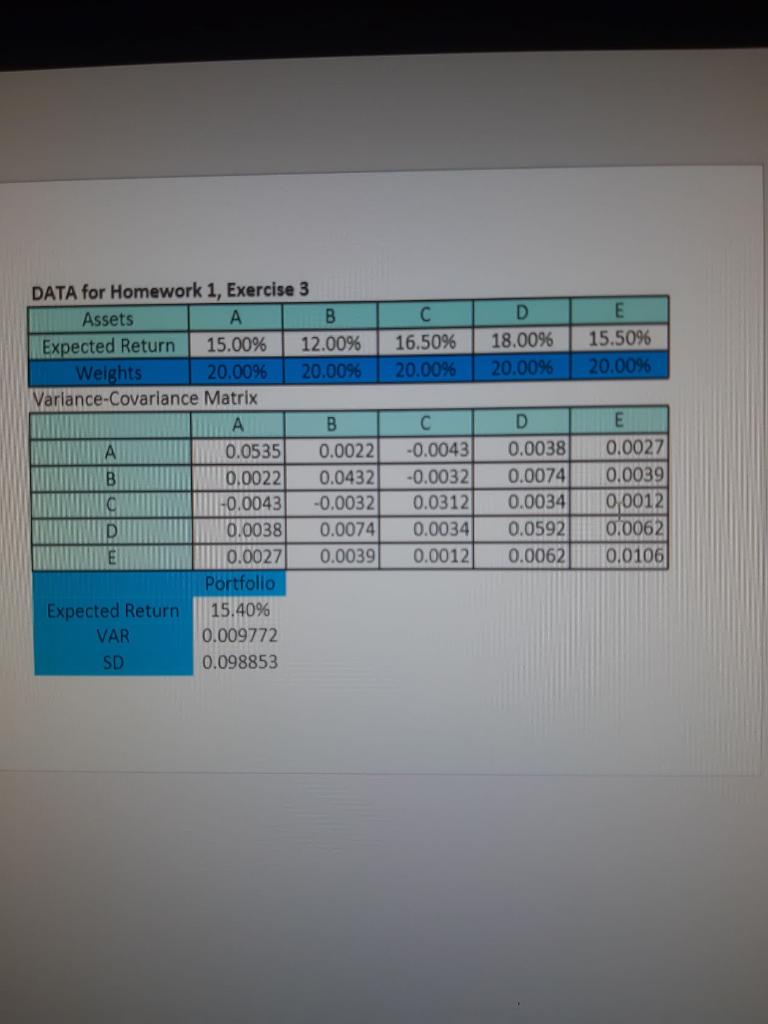

Question: 16.5096 20.00% D 18.0096 20.0096 E 15.5096 20.00% DATA for Homework 1, Exercise 3 Assets B Expected Return 15.00% 12.00% Weights 20.0096 20.0096 Variance-Covariance Matrix

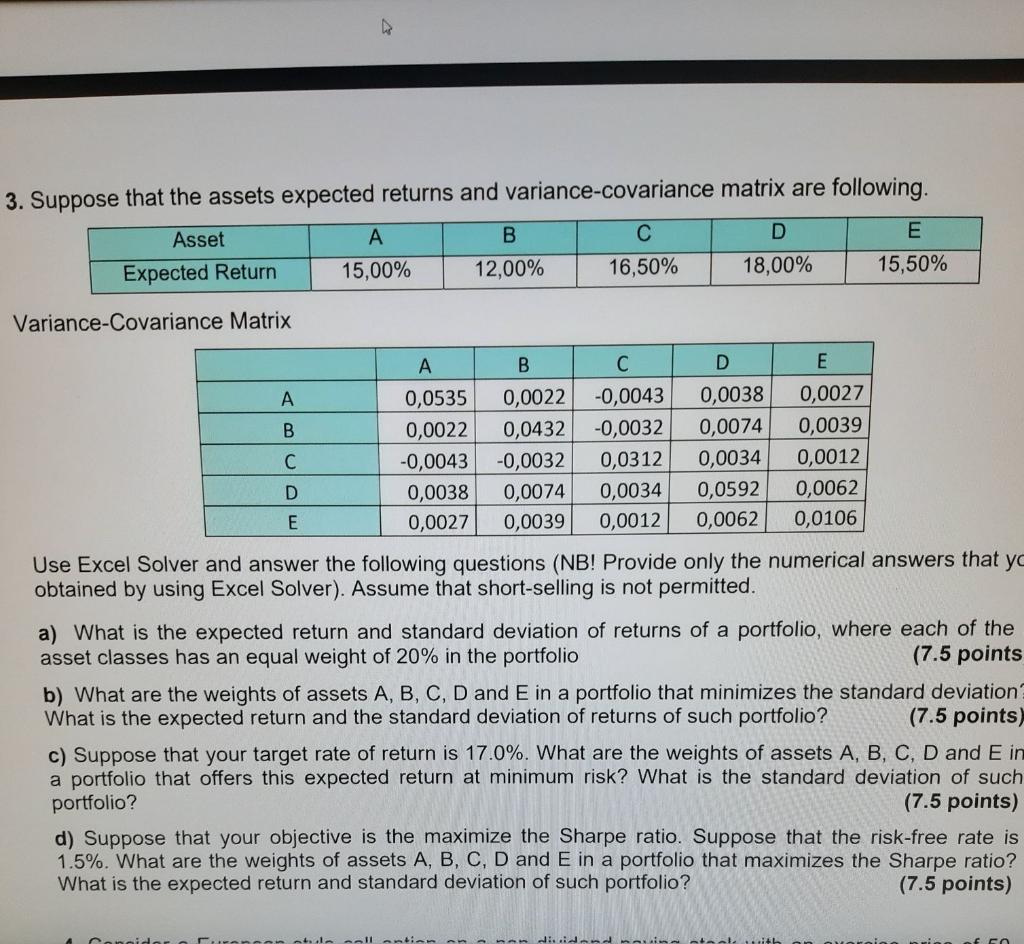

16.5096 20.00% D 18.0096 20.0096 E 15.5096 20.00% DATA for Homework 1, Exercise 3 Assets B Expected Return 15.00% 12.00% Weights 20.0096 20.0096 Variance-Covariance Matrix B A 0.0535 0.0022 B 0.0022 0.0432 -0.0043 -0.0032 D 0.0038 0.0074 E 0.0027 0.0039 Portfolio Expected Return 15.40% VAR 0.009772 SD 0.098853 -0.0043 -0.0032 0.0312 0.0034 0.0012 D 0.0038 0.0074 0.0034 0.0592 0.0062 E 0.0027 0.0039 0,0012 0.0062 0.0106 3. Suppose that the assets expected returns and variance-covariance matrix are following. Asset A B D E Expected Return 15,00% 12,00% 16,50% 18,00% 15,50% Variance-Covariance Matrix B C D E A 0,0535 0,0022 -0,0043 0,0038 0,0027 B 0,0022 0,0432 -0,0032 0,0074 0,0039 C -0,0043 -0,0032 0,0312 0,0034 0,0012 D 0,0038 0,0074 0,0034 0,0592 0,0062 E 0,0027 0,0039 0,0012 0,0062 0,0106 Use Excel Solver and answer the following questions (NB! Provide only the numerical answers that yo obtained by using Excel Solver). Assume that short-selling is not permitted. a) What is the expected return and standard deviation of returns of a portfolio, where each of the asset classes has an equal weight of 20% in the portfolio (7.5 points b) What are the weights of assets A, B, C, D and E in a portfolio that minimizes the standard deviation What is the expected return and the standard deviation of returns of such portfolio? (7.5 points) c) Suppose that your target rate of return is 17.0%. What are the weights of assets A, B, C, D and Ein a portfolio that offers this expected return at minimum risk? What is the standard deviation of such portfolio? (7.5 points) d) Suppose that your objective is the maximize the Sharpe ratio. Suppose that the risk-free rate is 1.5%. What are the weights of assets A, B, C, D and E in a portfolio that maximizes the Sharpe ratio? What is the expected return and standard deviation of such portfolio? (7.5 points) HL 16.5096 20.00% D 18.0096 20.0096 E 15.5096 20.00% DATA for Homework 1, Exercise 3 Assets B Expected Return 15.00% 12.00% Weights 20.0096 20.0096 Variance-Covariance Matrix B A 0.0535 0.0022 B 0.0022 0.0432 -0.0043 -0.0032 D 0.0038 0.0074 E 0.0027 0.0039 Portfolio Expected Return 15.40% VAR 0.009772 SD 0.098853 -0.0043 -0.0032 0.0312 0.0034 0.0012 D 0.0038 0.0074 0.0034 0.0592 0.0062 E 0.0027 0.0039 0,0012 0.0062 0.0106 3. Suppose that the assets expected returns and variance-covariance matrix are following. Asset A B D E Expected Return 15,00% 12,00% 16,50% 18,00% 15,50% Variance-Covariance Matrix B C D E A 0,0535 0,0022 -0,0043 0,0038 0,0027 B 0,0022 0,0432 -0,0032 0,0074 0,0039 C -0,0043 -0,0032 0,0312 0,0034 0,0012 D 0,0038 0,0074 0,0034 0,0592 0,0062 E 0,0027 0,0039 0,0012 0,0062 0,0106 Use Excel Solver and answer the following questions (NB! Provide only the numerical answers that yo obtained by using Excel Solver). Assume that short-selling is not permitted. a) What is the expected return and standard deviation of returns of a portfolio, where each of the asset classes has an equal weight of 20% in the portfolio (7.5 points b) What are the weights of assets A, B, C, D and E in a portfolio that minimizes the standard deviation What is the expected return and the standard deviation of returns of such portfolio? (7.5 points) c) Suppose that your target rate of return is 17.0%. What are the weights of assets A, B, C, D and Ein a portfolio that offers this expected return at minimum risk? What is the standard deviation of such portfolio? (7.5 points) d) Suppose that your objective is the maximize the Sharpe ratio. Suppose that the risk-free rate is 1.5%. What are the weights of assets A, B, C, D and E in a portfolio that maximizes the Sharpe ratio? What is the expected return and standard deviation of such portfolio? (7.5 points) HL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts