Question: 13 and 14 Ewing Corporation sold an office building that it used in its business for $885,388. Ewing bought the building ten years ago for

13 and 14

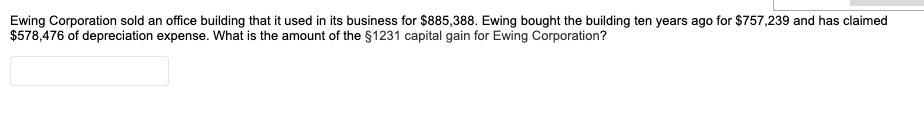

Ewing Corporation sold an office building that it used in its business for $885,388. Ewing bought the building ten years ago for $757,239 and has claimed $578,476 of depreciation expense. What is the amount of the 51231 capital gain for Ewing Corporation?

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Answer Part 1 For Corporations Section 291 recapture is 20 of the lesser of Depreciation taken or ... View full answer

Get step-by-step solutions from verified subject matter experts