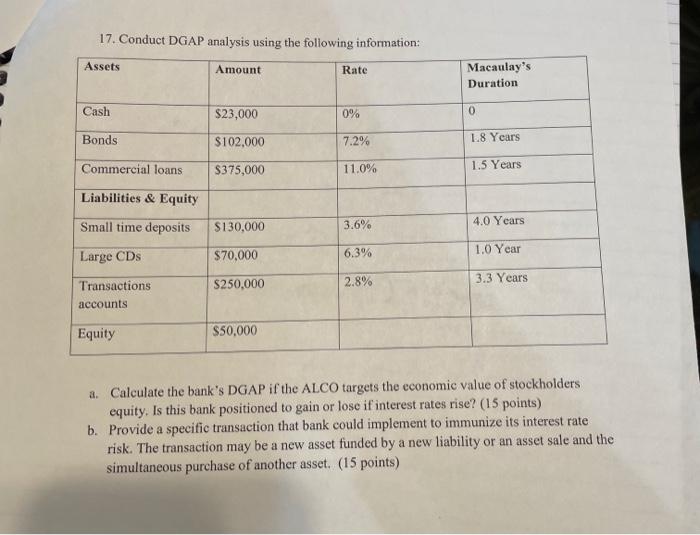

Question: 17. Conduct DGAP analysis using the following information: Assets Amount Rate Macaulay's Duration Cash $23,000 0% 0 Bonds $102,000 7.2% 1.8 Years Commercial loans $375,000

17. Conduct DGAP analysis using the following information: Assets Amount Rate Macaulay's Duration Cash $23,000 0% 0 Bonds $102,000 7.2% 1.8 Years Commercial loans $375,000 11.0% 1.5 Years Liabilities & Equity Small time deposits $130,000 3.6% 4.0 Years $70,000 Large CDs 6.3% 1.0 Year 3.3 Years $250,000 2.8% Transactions accounts Equity $50,000 a. Calculate the bank's DGAP if the ALCO targets the economic value of stockholders equity. Is this bank positioned to gain or lose if interest rates rise? (15 points) b. Provide a specific transaction that bank could implement to immunize its interest rate risk. The transaction may be a new asset funded by a new liability or an asset sale and the simultaneous purchase of another asset. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts