Question: 17) Johan Co. has an intangible asset, which it estimates wil have a useful life of 10 years, while Abco Co. has goodwill, which has

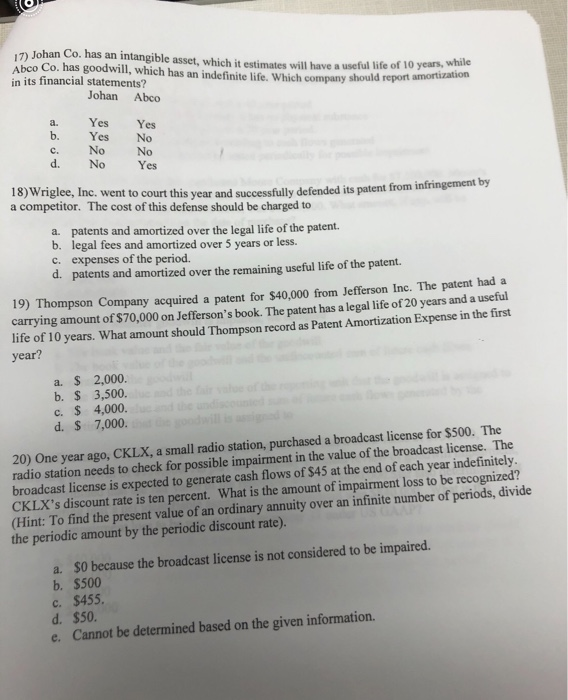

17) Johan Co. has an intangible asset, which it estimates wil have a useful life of 10 years, while Abco Co. has goodwill, which has an indefinite life. Which company should report amortization in its financial statements? Johan Abco Yes a. Yes No b. Yes No No c. No d. Yes 18)Wriglee, Inc. went to court this year and successfully defended its patent from infringement by a competitor. The cost of this defense should be charged to a. patents and amortized over the legal life of the patent. b. legal fees and amortized over 5 years or less. c. expenses of the period. d. patents and amortized over the remaining useful life of the patent. 19) Thompson Company acquired a patent for $40,000 from Jefferson Inc. The patent had a carrying amount of $70,000 on Jefferson's book. The patent has a legal life of 20 years and a useful life of 10 years. What amount should Thompson record as Patent Amortization Expense in the first year? a. $ 2,000. b. $ 3,500. c. $ 4,000. d. $ 7,000. 20) One year ago, CKLX, a small radio station, purchased a broadcast license for $500. The radio station needs to check for possible impairment in the value of the broadcast license. The broadcast license is expected to generate cash flows of $45 at the end of each year indefinitely. CKLX's discount rate is ten percent. What is the amount of impairment loss to be recognized? (Hint: To find the present value of an ordinary annuity over an infinite number of periods, divide the periodic amount by the periodic discount rate). a. $0 because the broadcast license is not considered to be impaired. b. $500 c. $455. d. $50. e. Cannot be determined based on the given information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts