Question: 1 1 1 3 ? 2 3 , 9 : 5 9 A M Training detail: Curriculum Test - Qualified Business Income Deduction ( 2

:

Training detail: Curriculum

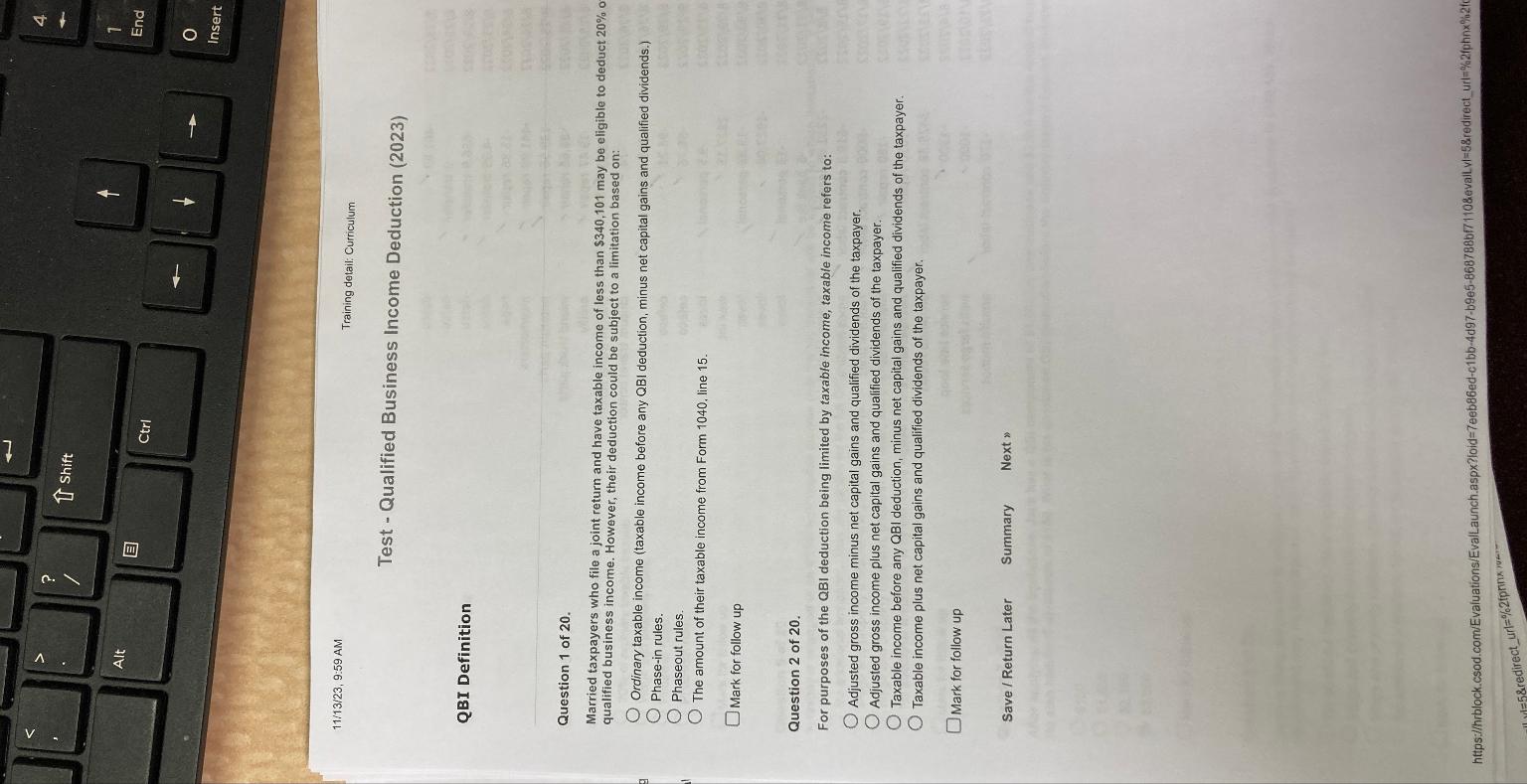

Test Qualified Business Income Deduction

QBI Definition

Question of

Married taxpayers who file a joint return and have taxable income of less than $ may be eligible to deduct o qualified business income. However, their deduction could be subject to a limitation based on:

Ordinary taxable income taxable income before any QBI deduction, minus net capital gains and qualified dividends.

Phasein rules.

Phaseout rules.

The amount of their taxable income from Form line

Mark for follow up

Question of

For purposes of the QBI deduction being limited by taxable income, taxable income refers to:

Adjusted gross income minus net capital gains and qualified dividends of the taxpayer.

Adjusted gross income plus net capital gains and qualified dividends of the taxpayer.

Taxable income before any QBI deduction, minus net capital gains and qualified dividends of the taxpayer. Taxable income plus net capital gains and qualified dividends of the taxpayer.

Mark for follow up

Save Return Later

Summary

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock