Question: 17. The projects year-3 cash flow is: * A. $6,500 B. $9,500 C. $2,500 D. $1,500 E. None of the above 18. The WACC is:

17. The projects year-3 cash flow is: *

A. $6,500

B. $9,500

C. $2,500

D. $1,500

E. None of the above

18. The WACC is: *

A. 0%

B. 10%

C. 10.2%

D. 12.45%

E. None of the above

19. The projects NPV is: *

A. $142.75

B. $129.77

C. $153.25

D. -$29.77

E. None of the above

20. Which of the following statements about NPV and IRR is least accurate? *

A. The IRR can be positive even if the NPV is negative.

B. When the IRR is equal to the cost of capital, the NPV will be Zero.

C. The NPV will be positive if the IRR is less than the cost of capital.

D. NPV assumes the cash flows can be reinvested at the projects cost of capital.

E. None of the above

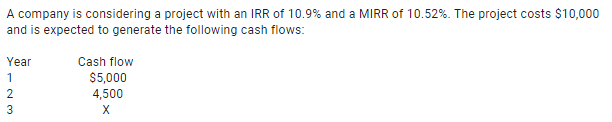

A company is considering a project with an IRR of 10.9% and a MIRR of 10.52%. The project costs $10,000 and is expected to generate the following cash flows: Year 1 Cash flow $5,000 4,500 2 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts