Question: 18? I need help asap! please provide full solution thanks A professor has two daughters that he hopes will one day go to college. Currently,

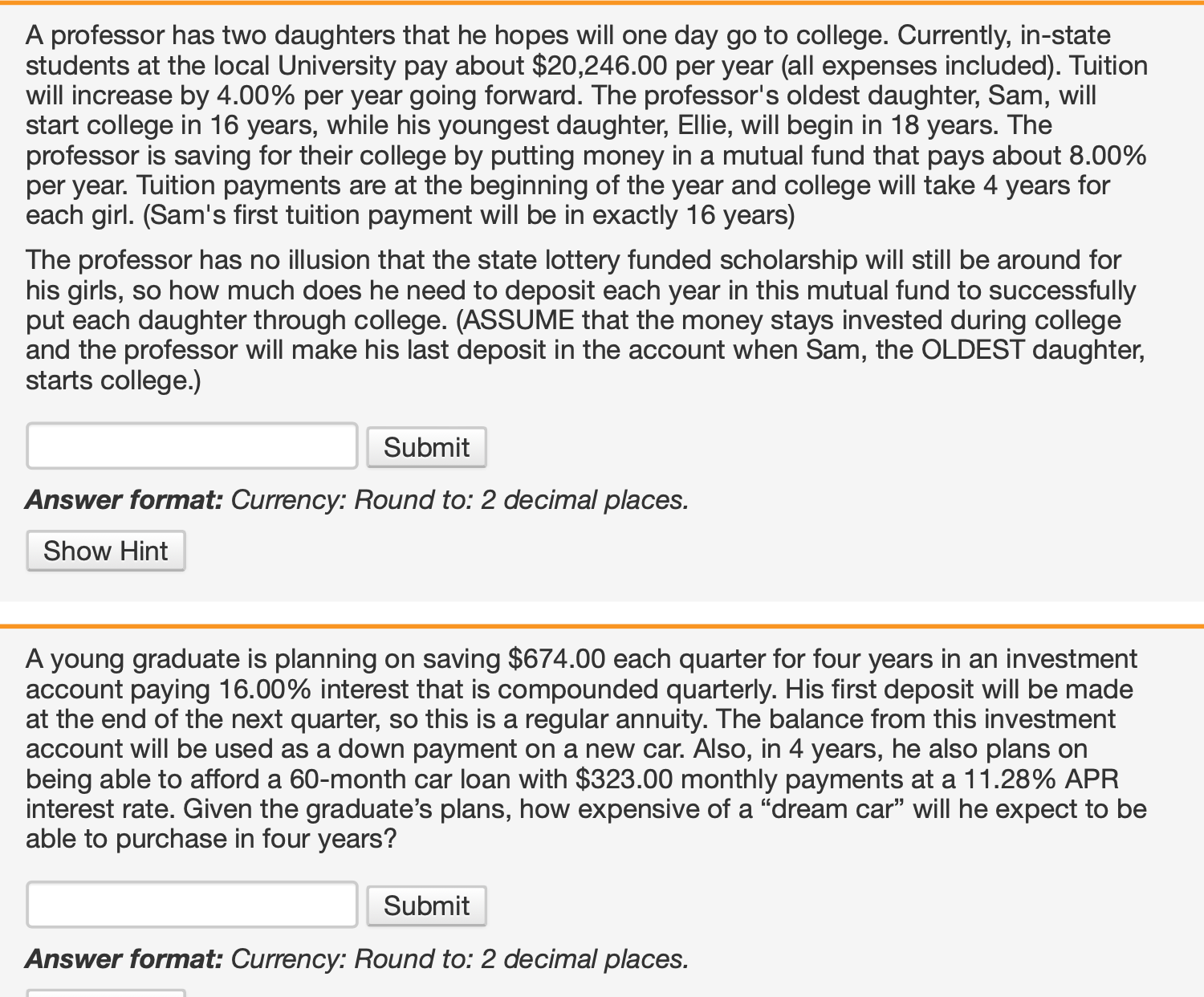

18? I need help asap! please provide full solution thanks  A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $20,246.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 8.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter, starts college.) Answer format: Currency: Round to: 2 decimal places. A young graduate is planning on saving $674.00 each quarter for four years in an investment account paying 16.00% interest that is compounded quarterly. His first deposit will be made at the end of the next quarter, so this is a regular annuity. The balance from this investment account will be used as a down payment on a new car. Also, in 4 years, he also plans on being able to afford a 60-month car loan with $323.00 monthly payments at a 11.28% APR interest rate. Given the graduate's plans, how expensive of a "dream car" will he expect to be able to purchase in four years? Answer format: Currency: Round to: 2 decimal places

A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $20,246.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 8.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter, starts college.) Answer format: Currency: Round to: 2 decimal places. A young graduate is planning on saving $674.00 each quarter for four years in an investment account paying 16.00% interest that is compounded quarterly. His first deposit will be made at the end of the next quarter, so this is a regular annuity. The balance from this investment account will be used as a down payment on a new car. Also, in 4 years, he also plans on being able to afford a 60-month car loan with $323.00 monthly payments at a 11.28% APR interest rate. Given the graduate's plans, how expensive of a "dream car" will he expect to be able to purchase in four years? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts