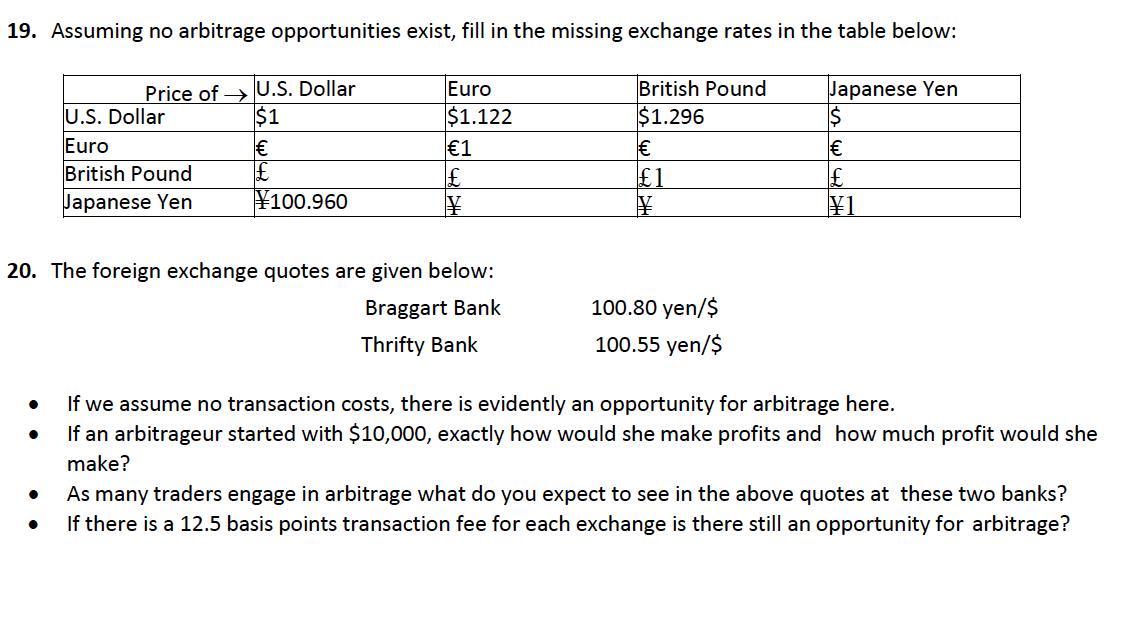

Question: 19. Assuming no arbitrage opportunities exist, fill in the missing exchange rates in the table below: Price of U.S. Dollar U.S. Dollar Euro $1

19. Assuming no arbitrage opportunities exist, fill in the missing exchange rates in the table below: Price of U.S. Dollar U.S. Dollar Euro $1 British Pound Japanese Yen 100.960 Euro $1.122 British Pound $1.296 Japanese Yen $ 1 1 1 20. The foreign exchange quotes are given below: Braggart Bank Thrifty Bank 100.80 yen/$ 100.55 yen/$ If we assume no transaction costs, there is evidently an opportunity for arbitrage here. If an arbitrageur started with $10,000, exactly how would she make profits and how much profit would she make? As many traders engage in arbitrage what do you expect to see in the above quotes at these two banks? If there is a 12.5 basis points transaction fee for each exchange is there still an opportunity for arbitrage?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts