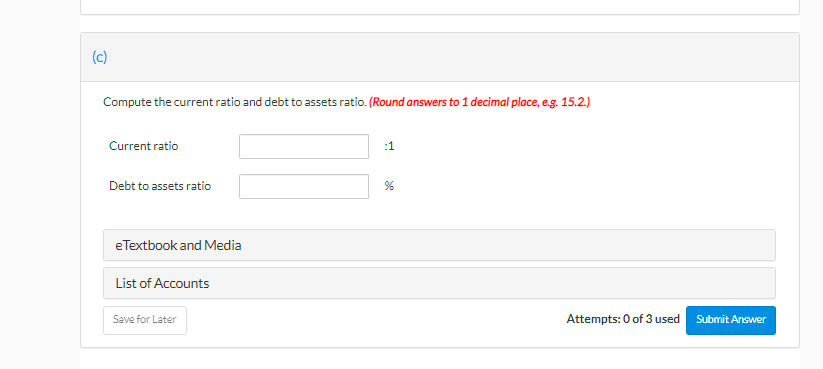

Question: 1C: BLOSSOM : Current Ratio: :1 Deb to asset ratio: % View Policies Show Attempt History Current Attempt in Progress (a1) These financial statement items

1C: BLOSSOM :

Current Ratio: :1

Deb to asset ratio: %

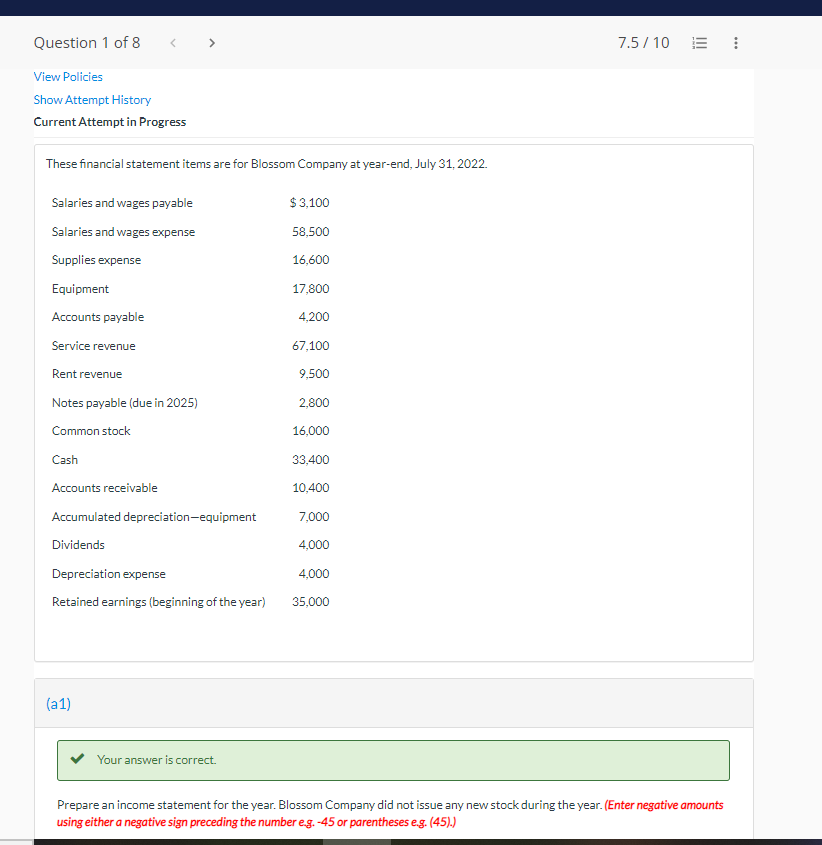

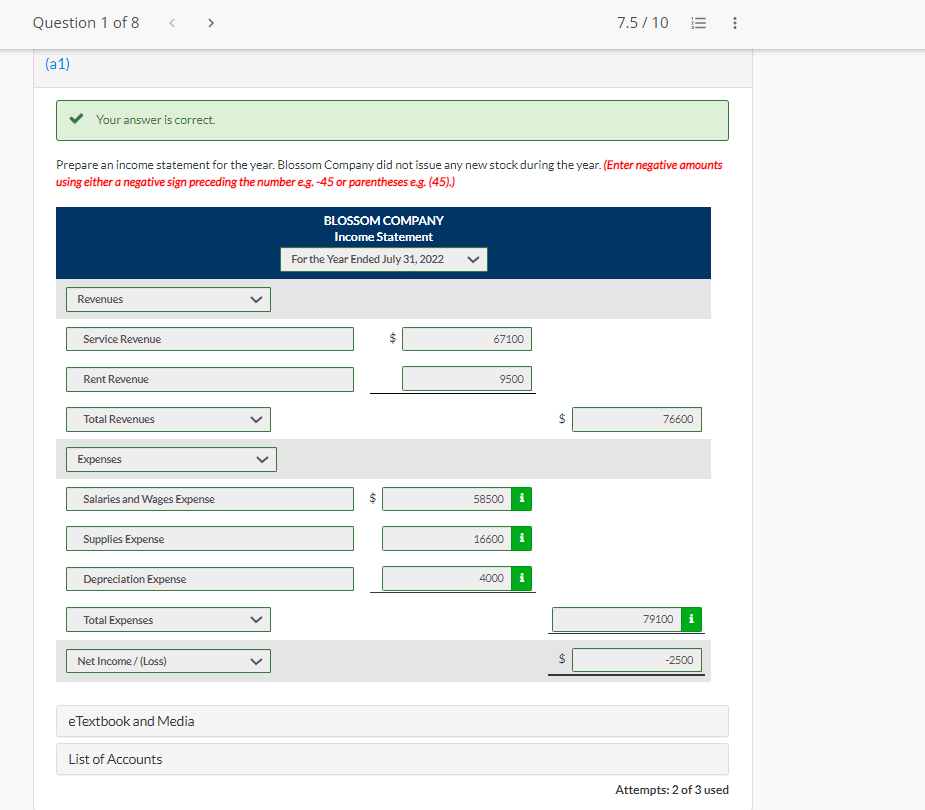

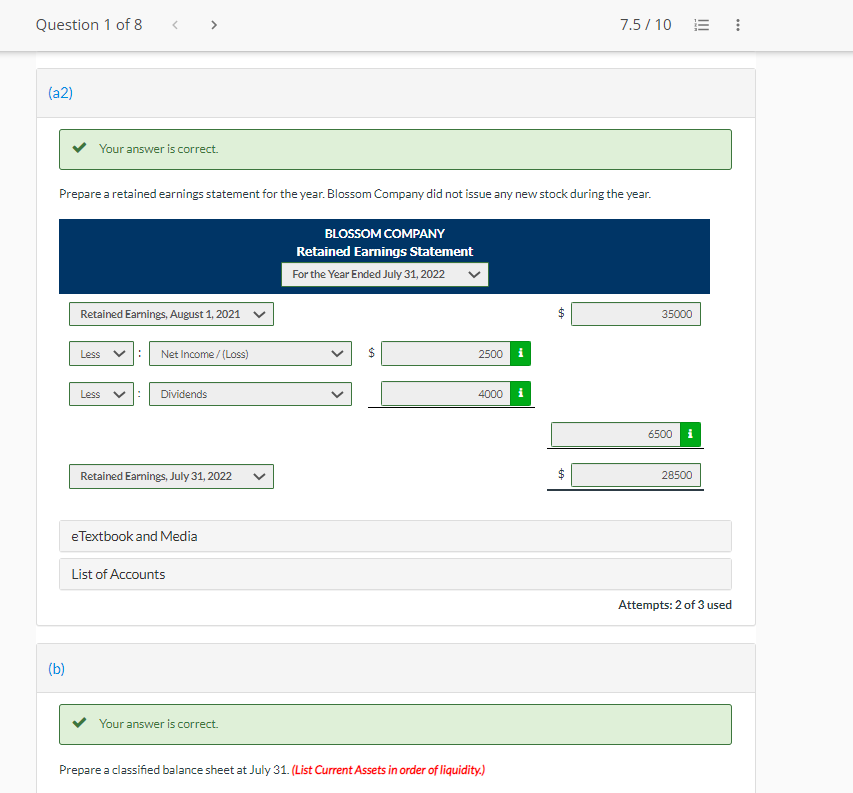

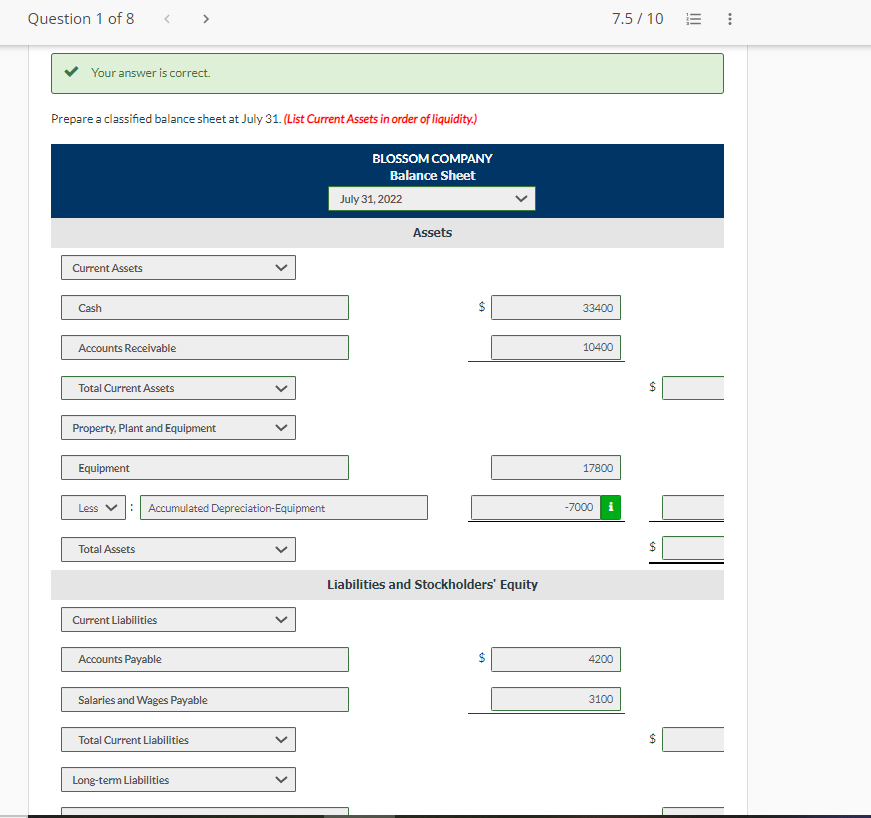

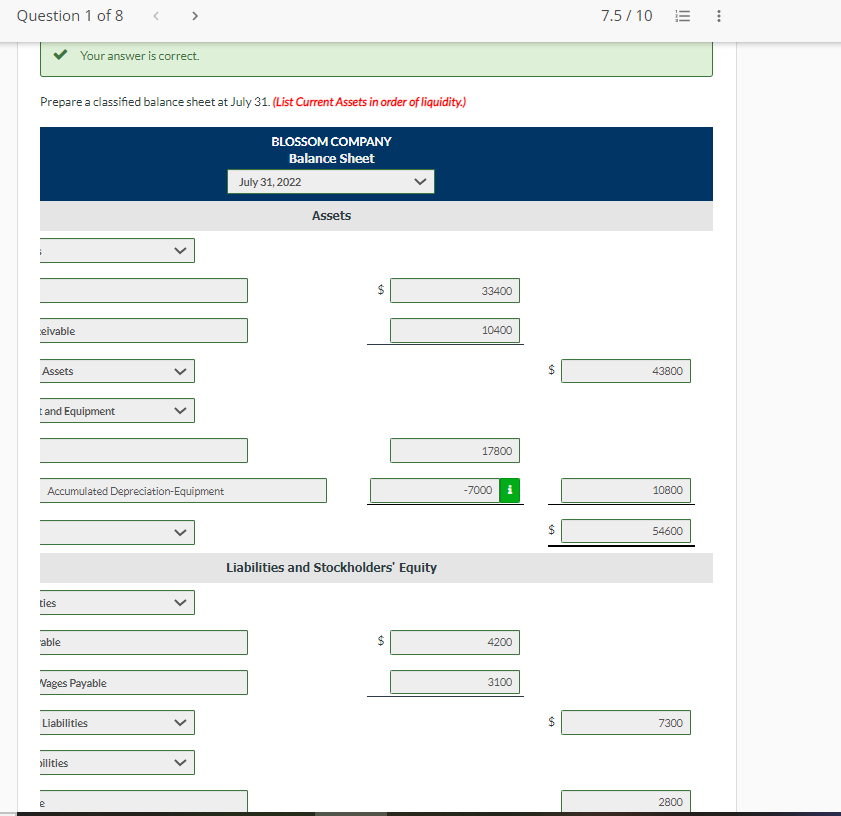

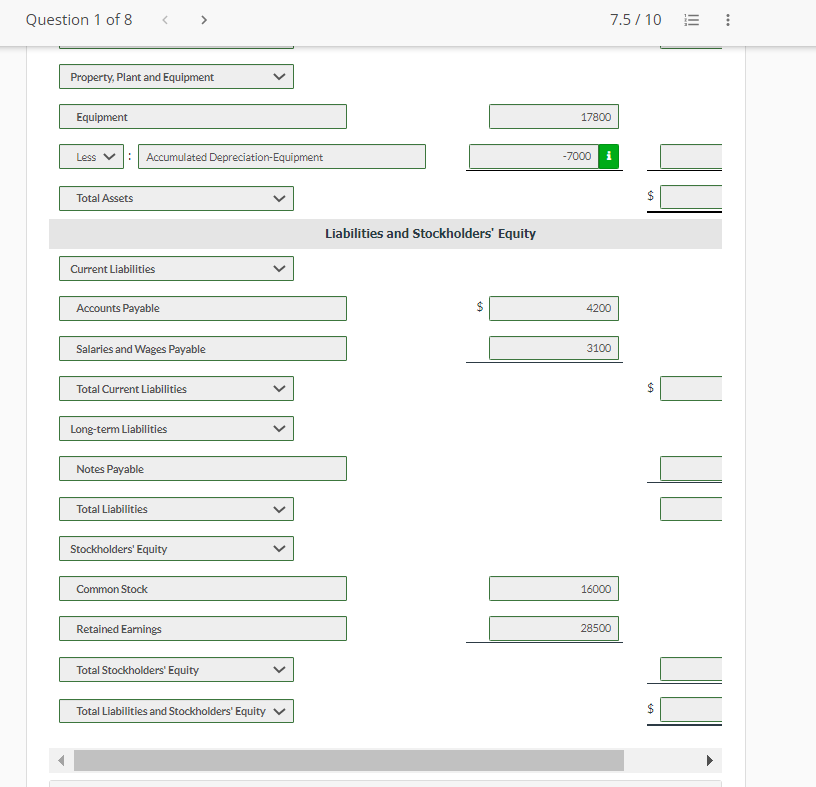

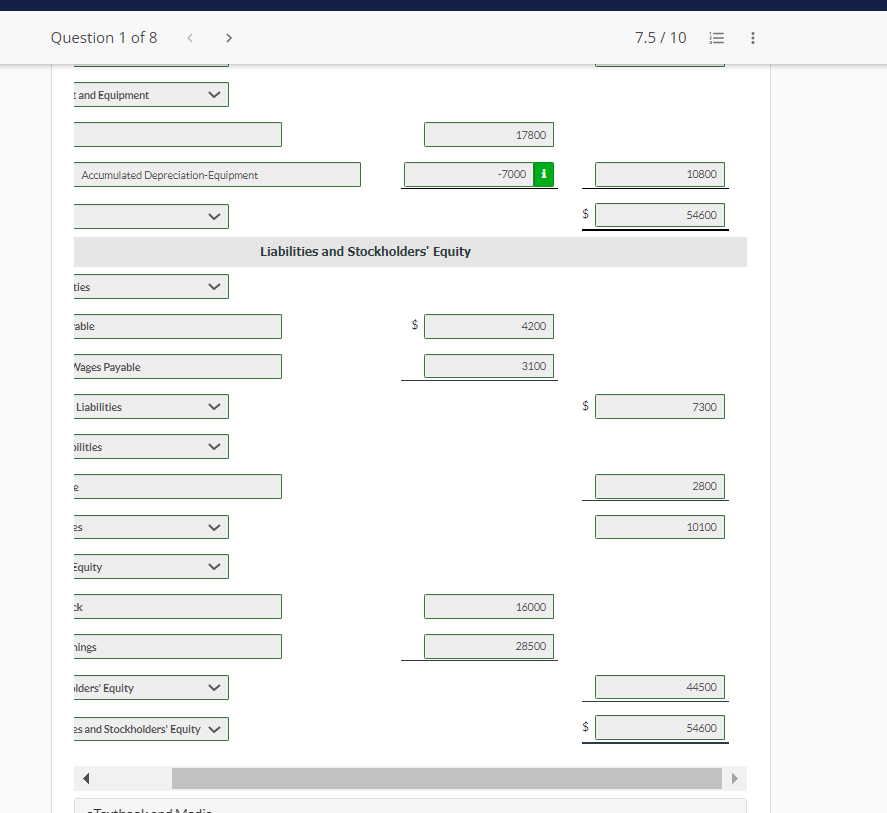

View Policies Show Attempt History Current Attempt in Progress (a1) These financial statement items are for Blossom Company at year-end, July 31,2022. Your answer is correct. Prepare an income statement for the year. Blossom Company did not issue any new stock during the year. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Your answer is correct. Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity.) Question 1 of 8 7.5/10 Your answer is correct. Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity.) BLOSSOM COMPANY Balance Sheet July 31, 2022 Assets Current Assets Cash $3400 Accounts Receivable 10400 Total Current Assets $ Property, Plant and Equipment \begin{tabular}{l} Equipment \\ Less : Accumulated Depreciation-Equipment \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 17800 \\ \hline7000i \\ \hline \end{tabular} Total Assets Liabilities and Stockholders' Equity Current Liabilities Accounts Payable $4200 Salaries and Wages Payable 3100 Total Current Liabilities $ Long-term Liabilities Your answer is correct. Question 1 of 8 7.5/10 Property, Plant and Equipment Equipment \begin{tabular}{|r|} \hline 17800 \\ \hline \end{tabular} Liabilities and Stockholders' Equity Current Liabilities \begin{tabular}{l} Accounts Payable \\ Salaries and Wages Payable \\ \hline \end{tabular} $44 Total Current Liabilities 3100 Long-term Liabilities Notes Payable Total Liabilities $ Stockholders' Equity Common Stock 16000 Retained Earnings 28500 Total Stockholders' Equity v Total Liabilities and Stockholders' Equity V Question 1 of 8 7.5/10: \begin{tabular}{l} \hline tand Equipment \\ \hline \\ \hline Accumulated Depreciation-Equipment \\ \hline \\ \hline ties \\ \hline \\ able \\ \hline \end{tabular} Nages Payable \begin{tabular}{l} $4200 \\ \hline 3100 \\ \hline \end{tabular} $7300 280010100 \begin{tabular}{|} \hline 16000 \\ \hline 28500 \\ \hline \end{tabular} \begin{tabular}{|} \hline 44500 \\ $4 \\ \hline \end{tabular} Compute the current ratio and debt to assets ratio. (Round answers to 1 decimal place, e.g. 15.2.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts