Question: 1st drop down options: reduce or increase 2nd drop down options: 25.20%, 24.00%, 27.60%, 26.40% Perpetuities are also called annuities with an extended, or unlimited,

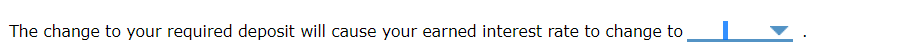

1st drop down options: reduce or increase

2nd drop down options: 25.20%, 24.00%, 27.60%, 26.40%

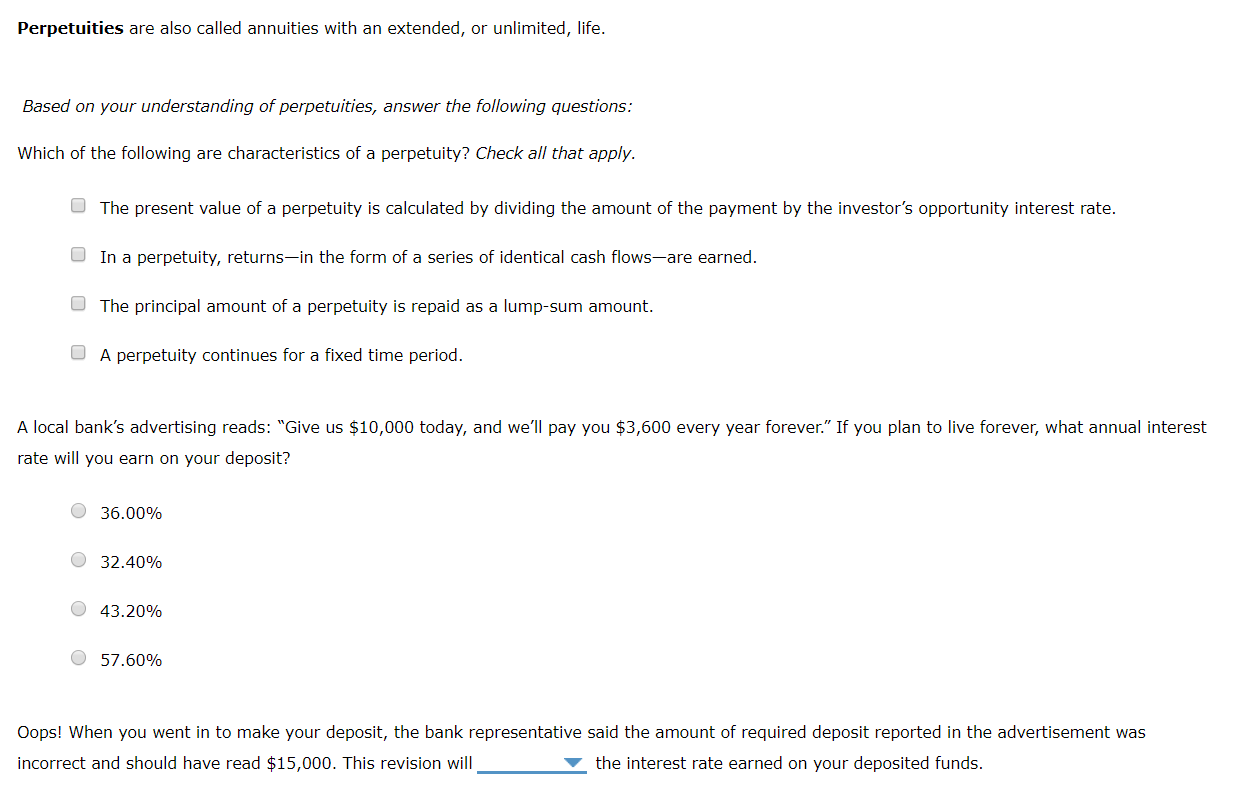

Perpetuities are also called annuities with an extended, or unlimited, life. Based on your understanding of perpetuities, answer the following questions: Which of the following are characteristics of a perpetuity? Check all that apply. The present value of a perpetuity is calculated by dividing the amount of the payment by the investor's opportunity interest rate. In a perpetuity, returns-in the form of a series of identical cash flows-are earned. The principal amount of a perpetuity is repaid as a lump-sum amount. O A perpetuity continues for a fixed time period. A local bank's advertising reads: "Give us $10,000 today, and we'll pay you $3,600 every year forever." If you plan to live forever, what annual interest rate will you earn on your deposit? O 36.00% O 32.40% O 43.20% 57.60% Oops! When you went in to make your deposit, the bank representative said the amount of required deposit reported in the advertisement was incorrect and should have read $15,000. This revision will the interest rate earned on your deposited funds. The change to your required deposit will cause your earned interest rate to change to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts