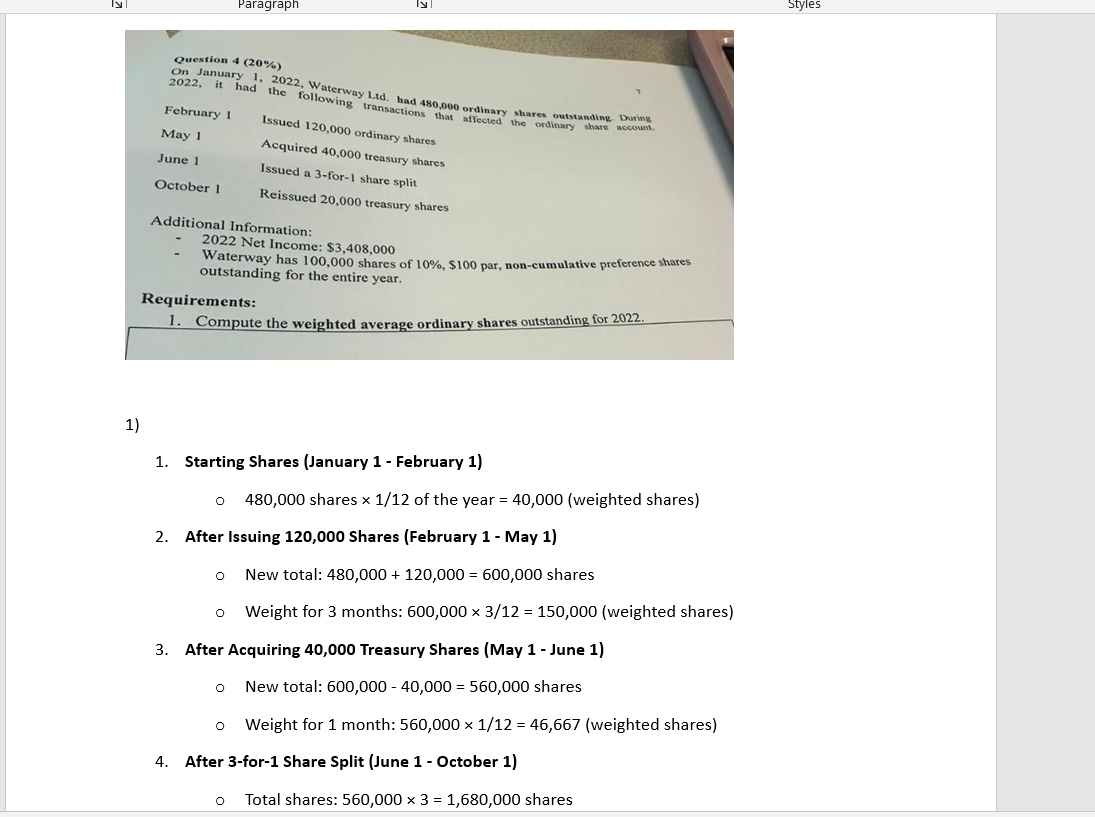

Question: 2 0 % 1 0 % , $ 1 0 0 par, non - cumulative preference shares outstanding for the entire year. Requirements: Compute the

$ par, noncumulative preference shares

outstanding for the entire year.

Requirements:

Compute the weighted average ordinary shares outstanding for

Starting Shares February

shares the year May shares

Weight for months: shares

After Acquiring Treasury Shares June

New total: shares

Weight for month: shares

After for Share Split October

Total shares: shares October shares

Weight for months: December shares

Weight for months: shares

Total Weighted Average Ordinary Shares

Adding all the weighted shares together:

shares

text shares shares Compute earnings per share for assuming that Waterway the company did

not declare and pay a preference dividend :

EPS

EPS

EPS~~ Details:

Number shares repurchased:

Price per share: $

Total cost repurchase: shares $$

Journal Entry:

Debit: Treasury Stock $

Credit: Cash $

September son, Phelps deolared cash divhdevds, which were

liquictaring clividencis.

Sep $ par value Each bond was

issued with one detachable share warrant. issuance, the net present value the

bonds without the warrants was $ Prepare the journal entry record the

issuance the bonds and the ehame warrante

Oct Phelps repurchased the convertible bonds issued April

Point $ while

the fair value the liability component was point only

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock