Question: 2. (10 pt each) Consider a non-dividend-paying stock whose current price $(0) = S is $50. After each period, there is a 40% chance that

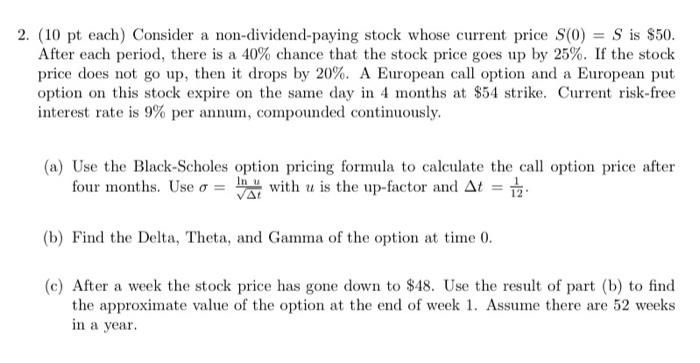

2. (10 pt each) Consider a non-dividend-paying stock whose current price $(0) = S is $50. After each period, there is a 40% chance that the stock price goes up by 25%. If the stock price does not go up, then it drops by 20%. A European call option and a European put option on this stock expire on the same day in 4 months at $54 strike. Current risk-free interest rate is 9% per annum, compounded continuously. (a) Use the Black-Scholes option pricing formula to calculate the call option price after four months. Use o = with u is the up-factor and At = 1 (b) Find the Delta, Theta, and Gamma of the option at time 0. (c) After a week the stock price has gone down to $48. Use the result of part (b) to find the approximate value of the option at the end of week 1. Assume there are 52 weeks in a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts