Question: 2 3 Question 2 What will be the value of an annuity where you invest $25,850 each year for 7 years earning an annual

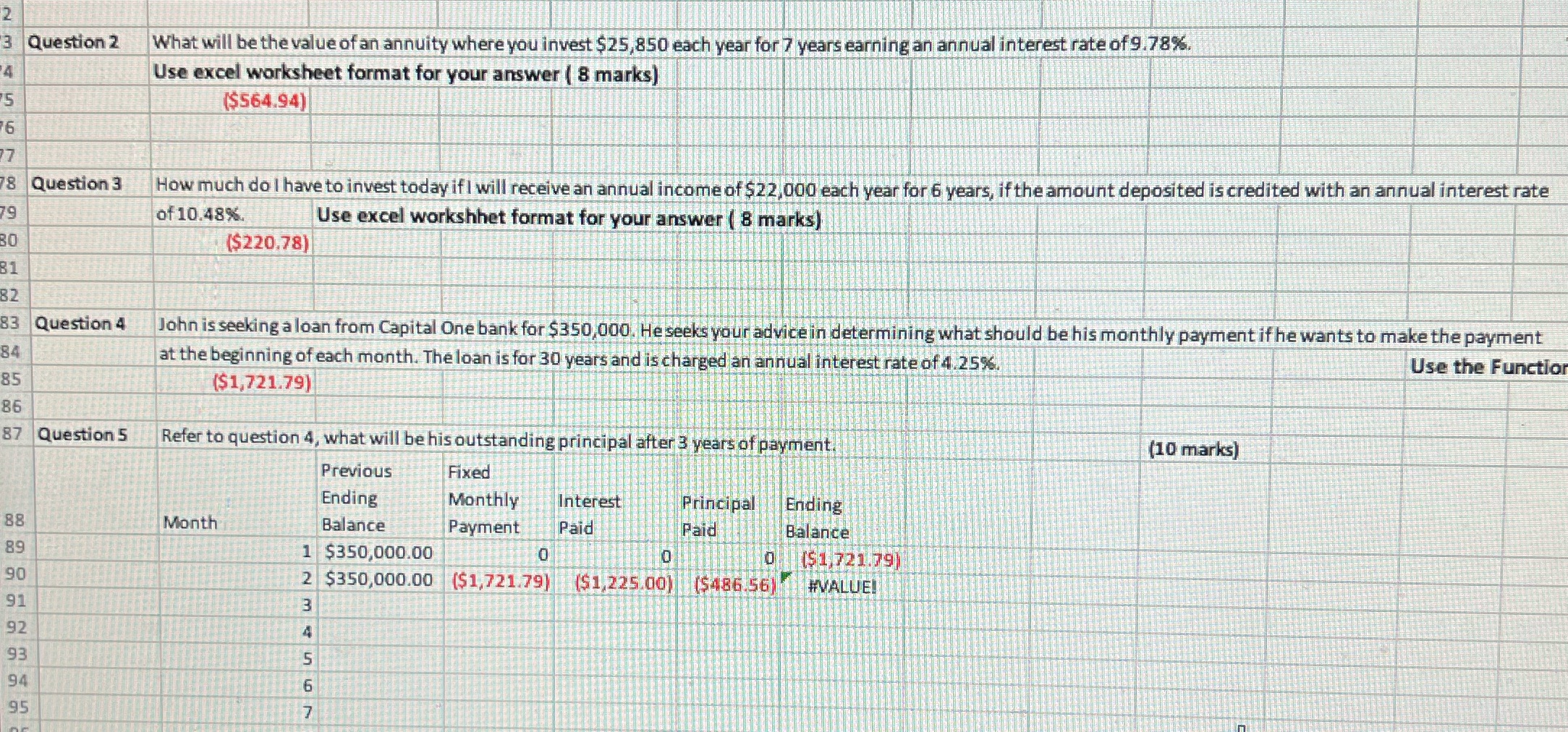

2 3 Question 2 What will be the value of an annuity where you invest $25,850 each year for 7 years earning an annual interest rate of 9.78%. Use excel worksheet format for your answer ( 8 marks) 4 75 76 77 ($564.94) 78 Question 3 How much do I have to invest today if I will receive an annual income of $22,000 each year for 6 years, if the amount deposited is credited with an annual interest rate Use excel workshhet format for your answer (8 marks) of 10.48%. 79 30 81 82 83 Question 4 84 85 86 87 Question 5 ($220.78) John is seeking a loan from Capital One bank for $350,000. He seeks your advice in determining what should be his monthly payment if he wants to make the payment at the beginning of each month. The loan is for 30 years and is charged an annual interest rate of 4.25%. ($1,721.79) Refer to question 4, what will be his outstanding principal after 3 years of payment. (10 marks) Use the Function Principal Paid Ending Balance 0 0 ($1,721.79) ($1,225.00) ($486.56) #VALUE! Previous Ending Fixed Monthly 88 Month Balance Payment Interest Paid 89 90 91 901 1 $350,000.00 0 2 $350,000.00 ($1,721.79) 3 92 4 99 93 5 94 9 95 7

Step by Step Solution

There are 3 Steps involved in it

To calculate the outstanding principal after 3 years of paymentwell need to use the PMT function in ... View full answer

Get step-by-step solutions from verified subject matter experts