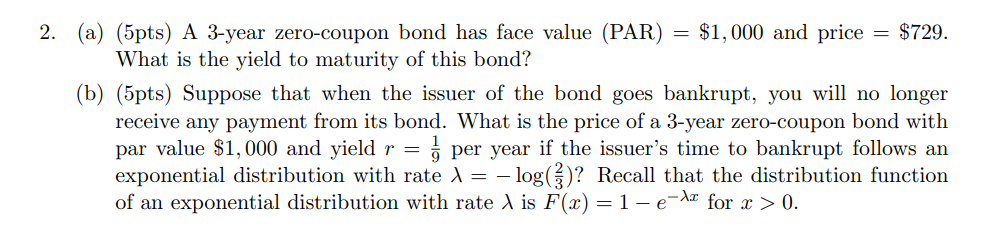

Question: 2. (a) (5pts) A 3-year zero-coupon bond has face value (PAR) = $1,000 and price = $729. What is the yield to maturity of

2. (a) (5pts) A 3-year zero-coupon bond has face value (PAR) = $1,000 and price = $729. What is the yield to maturity of this bond? (b) (5pts) Suppose that when the issuer of the bond goes bankrupt, you will no longer receive any payment from its bond. What is the price of a 3-year zero-coupon bond with par value $1,000 and yield r = 1/3 per year if the issuer's time to bankrupt follows an exponential distribution with rate = -log(33)? Recall that the distribution function of an exponential distribution with rate X is F(x) = 1 e for x > 0.

Step by Step Solution

There are 3 Steps involved in it

Absolutely I can help you with this a Yield to Maturity of the ZeroCoupon Bond For a zerocoupon bond the yield to maturity YTM is the discount rate th... View full answer

Get step-by-step solutions from verified subject matter experts