INVOLVE was incorporated as a not-for-profit voluntary health and welfare organization on January 1, 2020. During...

Fantastic news! We've Found the answer you've been seeking!

Transcribed Image Text:

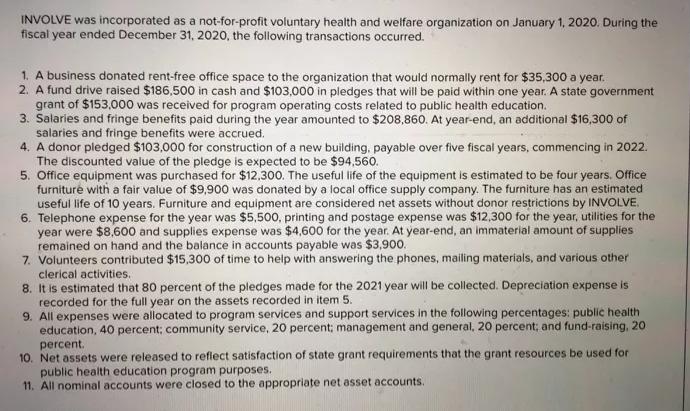

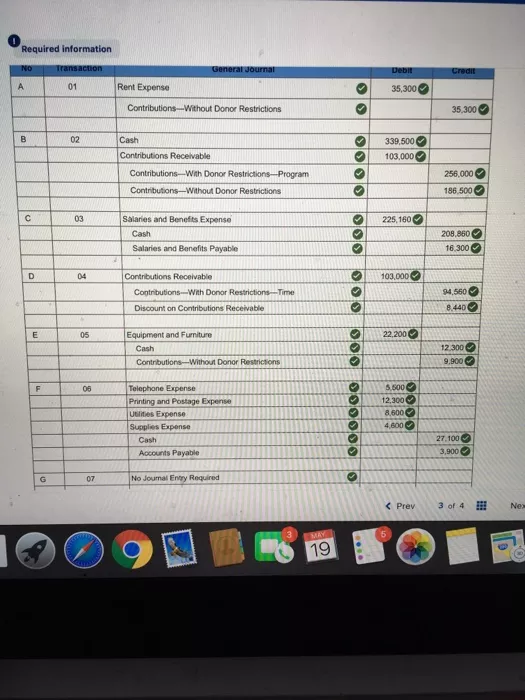

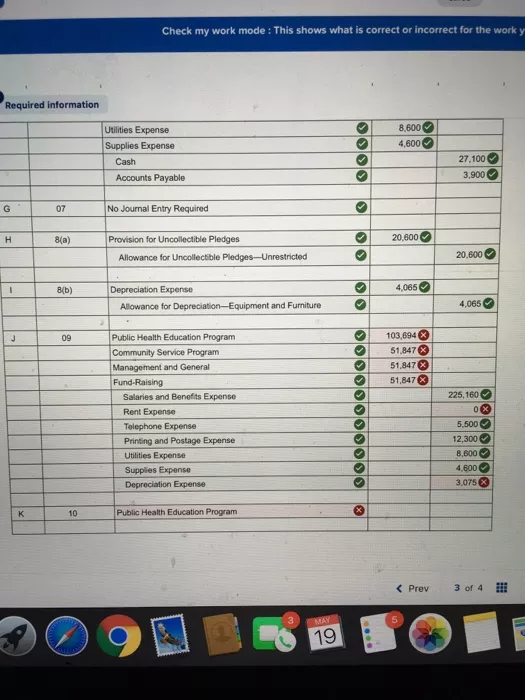

INVOLVE was incorporated as a not-for-profit voluntary health and welfare organization on January 1, 2020. During the fiscal year ended December 31, 2020, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,300 a year. 2. A fund drive raised $186,500 in cash and $103,000 in pledges that will be paid within one year. A state government grant of $153,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $208,860. At year-end, an additional $16,300 of salaries and fringe benefits were accrued. 4. A donor pledged $103,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,560. 5. Office equipment was purchased for $12,300. The useful life of the equipment is estimated to be four years. Office furniture with a fair value of $9,900 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE. 6. Telephone expense for the year was $5500, printing and postage expense was $12,300 for the year, utilities for the year were $8600 and supplies expense was $4,600 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,900. 7. Volunteers contributed $15,300 of time to help with answering the phones, mailing materials, and various other clerical activities. 8. It is estimated that 80 percent of the pledges made for the 2021 year will be collected. Depreciation expense is recorded for the full year on the assets recorded in item 5. 9. All expenses were allocated to program services and support services in the following percentages: public health education, 40 percent; community service, 20 percent; management and general, 20 percent; and fund-raising, 20 percent. 10. Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes. 11. All nominal accounts were closed to the appropriate net asset accounts. Required information Transaction No General Journal Debit Credit A Rent Expense 01 35,300O Contributions-Without Donor Restrictions 35,300 Cash Contributions Receivable B 02 339,500O 103,000O Contributions-With Donor Restrictions-Program 256,000 Contributions-Without Donor Restrictions 186,500 03 Salaries and Benefits Expense 225, 160 Cash 208,860 Salaries and Benefits Payable 16.300 D 04 Contributions Receivable 103,000 Contributions-Wth Donor Restrictions-Time 94,560 O Discount on Contributions Receivable 8.440 E 05 Equipment and Fumiture 22,200O Cash 12.300 O Contributions-Without Donor Restrictions 9.900 Telephone Expense Printing and Postage Expense Ublities Expense 5,500O 12,300 F 06 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required ( Prev 3 of 4 Ne MAY 19 Check my work mode : This shows what is correct or incorrect for the work y Required information Utilities Expense 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required 8(a) Provision for Uncollectible Pledges 20,600 Allowance for Uncollectible Pledges-Unrestricted 20,600 8(b) Depreciation Expense 4,065 Allowance for Depreciation-Equipment and Furniture 4,065 103,694 X 51,847X 51.847 51,8478 09 Public Health Education Program Community Service Program Management and General Fund-Raising Salaries and Benefits Expense 225, 160 Rent Expense Telephone Expense 5,500 Printing and Postage Expense 12,300 Utilities Expense 8,600 Supplies Expense 4,600 Depreciation Expense 3.075 X K 10 Public Health Education Program < Prev 3 of 4 MAY 19 INVOLVE was incorporated as a not-for-profit voluntary health and welfare organization on January 1, 2020. During the fiscal year ended December 31, 2020, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,300 a year. 2. A fund drive raised $186,500 in cash and $103,000 in pledges that will be paid within one year. A state government grant of $153,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $208,860. At year-end, an additional $16,300 of salaries and fringe benefits were accrued. 4. A donor pledged $103,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,560. 5. Office equipment was purchased for $12,300. The useful life of the equipment is estimated to be four years. Office furniture with a fair value of $9,900 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE. 6. Telephone expense for the year was $5500, printing and postage expense was $12,300 for the year, utilities for the year were $8600 and supplies expense was $4,600 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,900. 7. Volunteers contributed $15,300 of time to help with answering the phones, mailing materials, and various other clerical activities. 8. It is estimated that 80 percent of the pledges made for the 2021 year will be collected. Depreciation expense is recorded for the full year on the assets recorded in item 5. 9. All expenses were allocated to program services and support services in the following percentages: public health education, 40 percent; community service, 20 percent; management and general, 20 percent; and fund-raising, 20 percent. 10. Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes. 11. All nominal accounts were closed to the appropriate net asset accounts. Required information Transaction No General Journal Debit Credit A Rent Expense 01 35,300O Contributions-Without Donor Restrictions 35,300 Cash Contributions Receivable B 02 339,500O 103,000O Contributions-With Donor Restrictions-Program 256,000 Contributions-Without Donor Restrictions 186,500 03 Salaries and Benefits Expense 225, 160 Cash 208,860 Salaries and Benefits Payable 16.300 D 04 Contributions Receivable 103,000 Contributions-Wth Donor Restrictions-Time 94,560 O Discount on Contributions Receivable 8.440 E 05 Equipment and Fumiture 22,200O Cash 12.300 O Contributions-Without Donor Restrictions 9.900 Telephone Expense Printing and Postage Expense Ublities Expense 5,500O 12,300 F 06 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required ( Prev 3 of 4 Ne MAY 19 Check my work mode : This shows what is correct or incorrect for the work y Required information Utilities Expense 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required 8(a) Provision for Uncollectible Pledges 20,600 Allowance for Uncollectible Pledges-Unrestricted 20,600 8(b) Depreciation Expense 4,065 Allowance for Depreciation-Equipment and Furniture 4,065 103,694 X 51,847X 51.847 51,8478 09 Public Health Education Program Community Service Program Management and General Fund-Raising Salaries and Benefits Expense 225, 160 Rent Expense Telephone Expense 5,500 Printing and Postage Expense 12,300 Utilities Expense 8,600 Supplies Expense 4,600 Depreciation Expense 3.075 X K 10 Public Health Education Program < Prev 3 of 4 MAY 19 INVOLVE was incorporated as a not-for-profit voluntary health and welfare organization on January 1, 2020. During the fiscal year ended December 31, 2020, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,300 a year. 2. A fund drive raised $186,500 in cash and $103,000 in pledges that will be paid within one year. A state government grant of $153,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $208,860. At year-end, an additional $16,300 of salaries and fringe benefits were accrued. 4. A donor pledged $103,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,560. 5. Office equipment was purchased for $12,300. The useful life of the equipment is estimated to be four years. Office furniture with a fair value of $9,900 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE. 6. Telephone expense for the year was $5500, printing and postage expense was $12,300 for the year, utilities for the year were $8600 and supplies expense was $4,600 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,900. 7. Volunteers contributed $15,300 of time to help with answering the phones, mailing materials, and various other clerical activities. 8. It is estimated that 80 percent of the pledges made for the 2021 year will be collected. Depreciation expense is recorded for the full year on the assets recorded in item 5. 9. All expenses were allocated to program services and support services in the following percentages: public health education, 40 percent; community service, 20 percent; management and general, 20 percent; and fund-raising, 20 percent. 10. Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes. 11. All nominal accounts were closed to the appropriate net asset accounts. Required information Transaction No General Journal Debit Credit A Rent Expense 01 35,300O Contributions-Without Donor Restrictions 35,300 Cash Contributions Receivable B 02 339,500O 103,000O Contributions-With Donor Restrictions-Program 256,000 Contributions-Without Donor Restrictions 186,500 03 Salaries and Benefits Expense 225, 160 Cash 208,860 Salaries and Benefits Payable 16.300 D 04 Contributions Receivable 103,000 Contributions-Wth Donor Restrictions-Time 94,560 O Discount on Contributions Receivable 8.440 E 05 Equipment and Fumiture 22,200O Cash 12.300 O Contributions-Without Donor Restrictions 9.900 Telephone Expense Printing and Postage Expense Ublities Expense 5,500O 12,300 F 06 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required ( Prev 3 of 4 Ne MAY 19 Check my work mode : This shows what is correct or incorrect for the work y Required information Utilities Expense 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required 8(a) Provision for Uncollectible Pledges 20,600 Allowance for Uncollectible Pledges-Unrestricted 20,600 8(b) Depreciation Expense 4,065 Allowance for Depreciation-Equipment and Furniture 4,065 103,694 X 51,847X 51.847 51,8478 09 Public Health Education Program Community Service Program Management and General Fund-Raising Salaries and Benefits Expense 225, 160 Rent Expense Telephone Expense 5,500 Printing and Postage Expense 12,300 Utilities Expense 8,600 Supplies Expense 4,600 Depreciation Expense 3.075 X K 10 Public Health Education Program < Prev 3 of 4 MAY 19 INVOLVE was incorporated as a not-for-profit voluntary health and welfare organization on January 1, 2020. During the fiscal year ended December 31, 2020, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,300 a year. 2. A fund drive raised $186,500 in cash and $103,000 in pledges that will be paid within one year. A state government grant of $153,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $208,860. At year-end, an additional $16,300 of salaries and fringe benefits were accrued. 4. A donor pledged $103,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,560. 5. Office equipment was purchased for $12,300. The useful life of the equipment is estimated to be four years. Office furniture with a fair value of $9,900 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE. 6. Telephone expense for the year was $5500, printing and postage expense was $12,300 for the year, utilities for the year were $8600 and supplies expense was $4,600 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,900. 7. Volunteers contributed $15,300 of time to help with answering the phones, mailing materials, and various other clerical activities. 8. It is estimated that 80 percent of the pledges made for the 2021 year will be collected. Depreciation expense is recorded for the full year on the assets recorded in item 5. 9. All expenses were allocated to program services and support services in the following percentages: public health education, 40 percent; community service, 20 percent; management and general, 20 percent; and fund-raising, 20 percent. 10. Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes. 11. All nominal accounts were closed to the appropriate net asset accounts. Required information Transaction No General Journal Debit Credit A Rent Expense 01 35,300O Contributions-Without Donor Restrictions 35,300 Cash Contributions Receivable B 02 339,500O 103,000O Contributions-With Donor Restrictions-Program 256,000 Contributions-Without Donor Restrictions 186,500 03 Salaries and Benefits Expense 225, 160 Cash 208,860 Salaries and Benefits Payable 16.300 D 04 Contributions Receivable 103,000 Contributions-Wth Donor Restrictions-Time 94,560 O Discount on Contributions Receivable 8.440 E 05 Equipment and Fumiture 22,200O Cash 12.300 O Contributions-Without Donor Restrictions 9.900 Telephone Expense Printing and Postage Expense Ublities Expense 5,500O 12,300 F 06 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required ( Prev 3 of 4 Ne MAY 19 Check my work mode : This shows what is correct or incorrect for the work y Required information Utilities Expense 8,600 Supplies Expense 4,600 Cash 27,100 Accounts Payable 3,900 07 No Journal Entry Required 8(a) Provision for Uncollectible Pledges 20,600 Allowance for Uncollectible Pledges-Unrestricted 20,600 8(b) Depreciation Expense 4,065 Allowance for Depreciation-Equipment and Furniture 4,065 103,694 X 51,847X 51.847 51,8478 09 Public Health Education Program Community Service Program Management and General Fund-Raising Salaries and Benefits Expense 225, 160 Rent Expense Telephone Expense 5,500 Printing and Postage Expense 12,300 Utilities Expense 8,600 Supplies Expense 4,600 Depreciation Expense 3.075 X K 10 Public Health Education Program < Prev 3 of 4 MAY 19

Expert Answer:

Answer rating: 100% (QA)

Date Particulars Amount Dr Amount Cr 1 Rent Expenses 35300 Contributions Without Donor Restrictions ... View the full answer

Related Book For

Accounting for Governmental and Nonprofit Entities

ISBN: 978-0078025822

17th edition

Authors: Jacqueline Reck, Suzanne Lowensohn, Earl Wilson

Posted Date:

Students also viewed these accounting questions

-

A private college has received pledges that are due within one year and pledges that are long-term (that is, due in more than one year). How will the college report the pledges in its financial...

-

A citys General Fund received cash from the following sources during fiscal year 2012. All the receipts were credited to revenue accounts. Identify the incorrect credits (some may be correct), and...

-

Suppose that u(x) is differentiable and strictly quasiconcave and that the Walrasian demand function x(p, w) is differentiable. Show the following: If u(x) is homogeneous of degree one, then the...

-

In an organization, leaders treat employees as ends when they ______. Multiple choice question. restrict employees' choices allow employees to create their own purposes assume that the employees'...

-

Walking beside you, your friend takes 50 strides per minute while you take 48 strides per minute. If you start in step, you'll soon be out of step. When will you be in step again?

-

Jean Marsh owns a small business making and selling children's toys. The following trial balance was extracted from her books on 31 December 2017. You are given the following additional information....

-

Lynn Goldsmith is a photographer known for her photographs of famous musicians. In 1981, Goldsmith had a photography session with the singer Prince. Three years later, Vanity Fair obtained a license...

-

Dozier Industries Inc. manufactures only one product. For the year ended December 31, 2014, the contribution margin increased by $38,500 from the planned level of $1,386,000. The president of Dozier...

-

thank you I've been having lots of troubles opening any documents in full they just appear as blank would you know why this is or perhaps be able to assist me

-

Holman Electronics manufactures audio equipment, selling it through various distributors. Holmans days sales outstanding (Accounts receivable/Average daily credit sales) figures increased steadily in...

-

What are some key functions of a Project Management Office ( PMO ) ? Implementing project management best practices Managing the organization s income and expenses Creating project documentation,...

-

Please read the paper by Ernesto Dal Bo & Guo Xu: "How did a $9 Billion Health Tech Startup End up DOA?" 1. The outcome of the Theranos saga is quite exceptional. How exceptional do you think the...

-

Describe the people dimension of information systems and give an example. Is this dimension as vital as the technology dimension when considering a technology- based solution to a business problem?

-

Type of adjustment Classify the following items as (1) accrued revenue, (2) accrued expense, (3) unearned revenue, or (4) prepaid expense: Line Item Description Classification a. Cash paid for future...

-

Write the email to Rachel (you can make up an email address) that will achieve the negative-news goals of clarity, acceptance, and positive image. Remember that this case deliberately contains...

-

Table 1. Projected cash flows for TopMaverick Ltd (in m) 2016 2017 2018 2019 2020 EBIT(1-t) 80.50 86.14 92.16 98.62 Incremental Working 45.00 48.15 46.71 44.37 Capital Net Capital Expenditure 13.50...

-

Q3- Assuming monthly payments, which one of the following plans are better for buying a $15,000 van? a) 6% on the full amount for 4 years. b) $2500 discount and 12% interest on the remaining amount...

-

During the year land was revalued and the surplus reported as Revaluation surplus; and an asset costing 80,000, written down to 38,000, was sold for 40,000. Identify the cost of any non-current...

-

*In the 2010 CAFR, Detroit indicated that its general obligation debt rating had been downgraded by Moody's Investors Services from a Ba2 to a Ba3. Based on its fourth quarter Performance Dashboard...

-

GASB Concepts Statement No. 1, "Objectives of Financial Reporting," states that "Accountability is the cornerstone of all financial reporting in government." FASB Statements of Financial Accounting...

-

What are the benefits of having an audit committee?

-

Are there any activities in a family that you believe should be allocated by a market? What characteristics do those activities have?

-

What is the difference between socialism in theory and socialism in practice?

-

Into what three sectors are market economies generally broken up?

Study smarter with the SolutionInn App