Question: 2. (a) Given the risk-neutral process dS/S = rdt + odz, with o being constant, show that (S7, ST, ... STK | So) = S

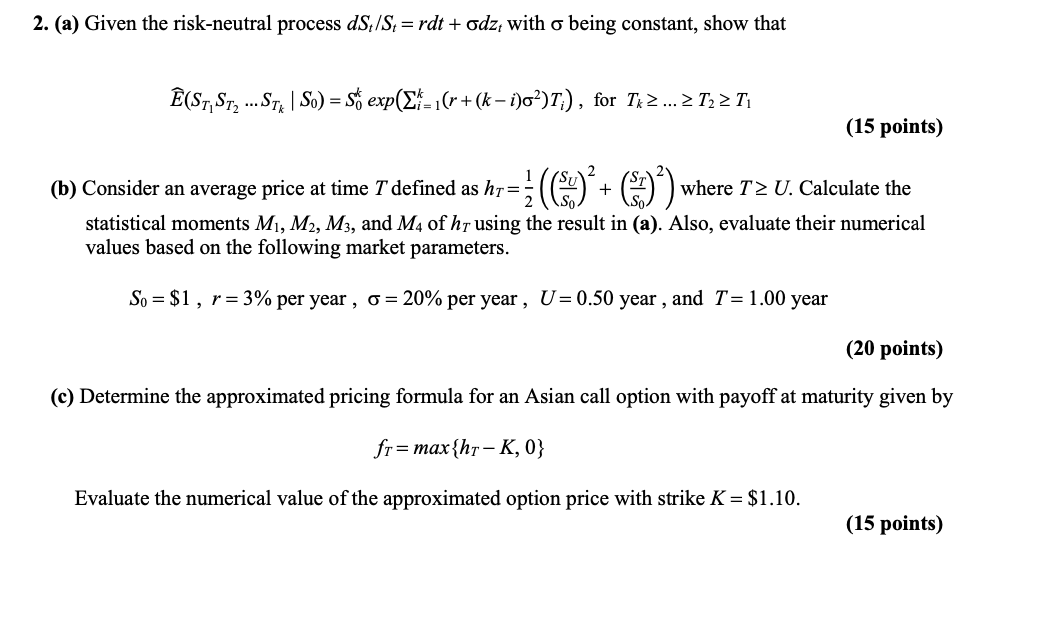

2. (a) Given the risk-neutral process dS/S = rdt + odz, with o being constant, show that (S7, ST, ... STK | So) = S exp(Ek=(r + (k 1)02)T;), for Tx 2 ... 2 T22 T (15 points) + (b) Consider an average price at time T defined as ht= where TZ U. Calculate the statistical moments M, M2, M3, and M4 of hy using the result in (a). Also, evaluate their numerical values based on the following market parameters. So = $1, r= 3% per year, o = 20% per year, U=0.50 year, and T=1.00 year (20 points) (c) Determine the approximated pricing formula for an Asian call option with payoff at maturity given by fr=max{hr-K, 0} Evaluate the numerical value of the approximated option price with strike K = $1.10. (15 points) 2. (a) Given the risk-neutral process dS/S = rdt + odz, with o being constant, show that (S7, ST, ... STK | So) = S exp(Ek=(r + (k 1)02)T;), for Tx 2 ... 2 T22 T (15 points) + (b) Consider an average price at time T defined as ht= where TZ U. Calculate the statistical moments M, M2, M3, and M4 of hy using the result in (a). Also, evaluate their numerical values based on the following market parameters. So = $1, r= 3% per year, o = 20% per year, U=0.50 year, and T=1.00 year (20 points) (c) Determine the approximated pricing formula for an Asian call option with payoff at maturity given by fr=max{hr-K, 0} Evaluate the numerical value of the approximated option price with strike K = $1.10. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts