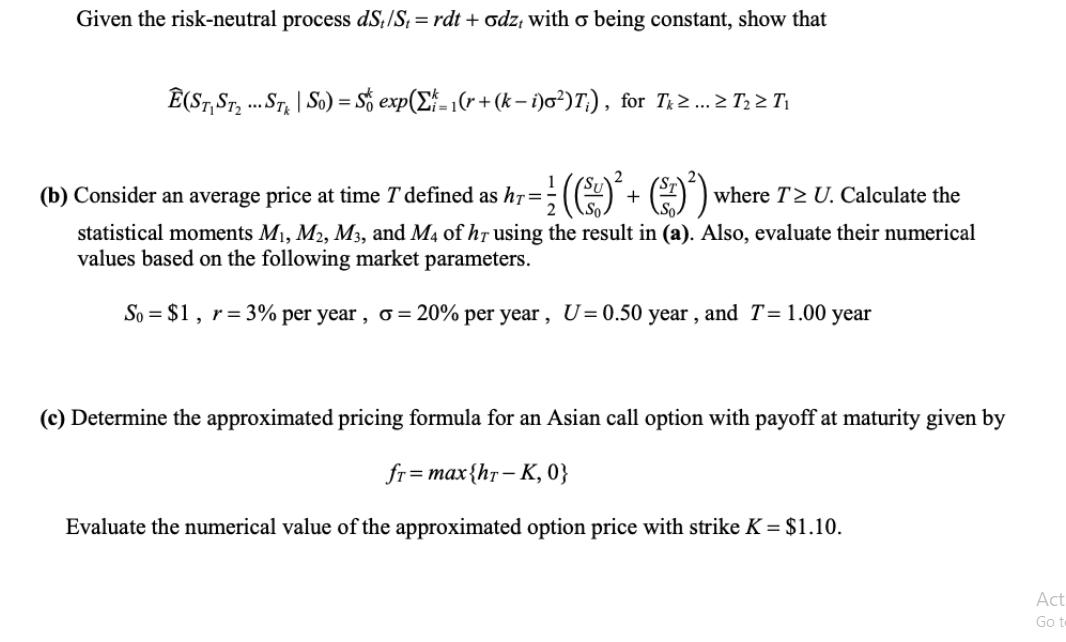

Question: Given the risk-neutral process dS/S = rdt + odz, with o being constant, show that E(STST...ST | SO) = Sexp(-1(r + (k-i)o)T), for T...>

Given the risk-neutral process dS/S = rdt + odz, with o being constant, show that E(STST...ST | SO) = Sexp(-1(r + (k-i)o)T), for T...> T > T (b) Consider an average price at time T defined as ht= = ((+) + () where TZ U. Calculate the statistical moments M, M2, M3, and M4 of hr using the result in (a). Also, evaluate their numerical values based on the following market parameters. So= $1, r= 3% per year, o = 20% per year, U=0.50 year, and T = 1.00 year (c) Determine the approximated pricing formula for an Asian call option with payoff at maturity given by fr=max{hr-K, 0} Evaluate the numerical value of the approximated option price with strike K = $1.10. Act Go t

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

To solve this problem we will use the given riskneutral process and the provided information a Proof ... View full answer

Get step-by-step solutions from verified subject matter experts