Question: 2. Answer both parts Part (a) Marcus plc makes components for the consumer electronics industry. On 1 October 2019, Marcus entered into a contract for

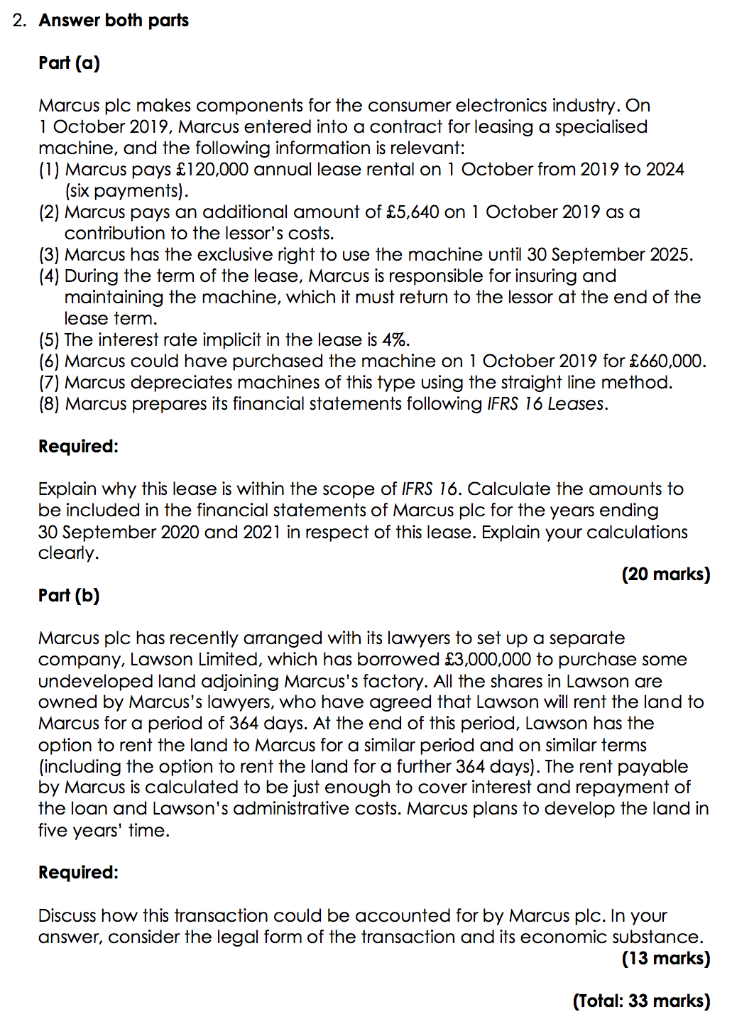

2. Answer both parts Part (a) Marcus plc makes components for the consumer electronics industry. On 1 October 2019, Marcus entered into a contract for leasing a specialised machine, and the following information is relevant: (1) Marcus pays 120,000 annual lease rental on 1 October from 2019 to 2024 (six payments). (2) Marcus pays an additional amount of 5,640 on 1 October 2019 as a contribution to the lessor's costs. (3) Marcus has the exclusive right to use the machine until 30 September 2025. (4) During the term of the lease, Marcus is responsible for insuring and maintaining the machine, which it must return the lessor at the end of the lease term. (5) The interest rate implicit in the lease is 4%. (6) Marcus could have purchased the machine on 1 October 2019 for 660,000. (7) Marcus depreciates machines of this type using the straight line method. (8) Marcus prepares its financial statements following IFRS 16 Leases. Required: Explain why this lease is within the scope of IFRS 16. Calculate the amounts to be included in the financial statements of Marcus plc for the years ending 30 September 2020 and 2021 in respect of this lease. Explain your calculations clearly. (20 marks) Part (b) Marcus plc has recently arranged with its lawyers to set up a separate company, Lawson Limited, which has borrowed 3,000,000 to purchase some undeveloped land adjoining Marcus's factory. All the shares in Lawson are owned by Marcus's lawyers, who have agreed that Lawson will rent the land to Marcus for a period of 364 days. At the end of this period, Lawson has the option to rent the land to Marcus for a similar period and on similar terms (including the option to rent the land for a further 364 days). The rent payable by Marcus is calculated to be just enough to cover interest and repayment of the loan and Lawson's administrative costs. Marcus plans to develop the land in five years' time. Required: Discuss how this transaction could be accounted for by Marcus plc. In your answer, consider the legal form of the transaction and its economic substance. (13 marks) (Total: 33 marks) 2. Answer both parts Part (a) Marcus plc makes components for the consumer electronics industry. On 1 October 2019, Marcus entered into a contract for leasing a specialised machine, and the following information is relevant: (1) Marcus pays 120,000 annual lease rental on 1 October from 2019 to 2024 (six payments). (2) Marcus pays an additional amount of 5,640 on 1 October 2019 as a contribution to the lessor's costs. (3) Marcus has the exclusive right to use the machine until 30 September 2025. (4) During the term of the lease, Marcus is responsible for insuring and maintaining the machine, which it must return the lessor at the end of the lease term. (5) The interest rate implicit in the lease is 4%. (6) Marcus could have purchased the machine on 1 October 2019 for 660,000. (7) Marcus depreciates machines of this type using the straight line method. (8) Marcus prepares its financial statements following IFRS 16 Leases. Required: Explain why this lease is within the scope of IFRS 16. Calculate the amounts to be included in the financial statements of Marcus plc for the years ending 30 September 2020 and 2021 in respect of this lease. Explain your calculations clearly. (20 marks) Part (b) Marcus plc has recently arranged with its lawyers to set up a separate company, Lawson Limited, which has borrowed 3,000,000 to purchase some undeveloped land adjoining Marcus's factory. All the shares in Lawson are owned by Marcus's lawyers, who have agreed that Lawson will rent the land to Marcus for a period of 364 days. At the end of this period, Lawson has the option to rent the land to Marcus for a similar period and on similar terms (including the option to rent the land for a further 364 days). The rent payable by Marcus is calculated to be just enough to cover interest and repayment of the loan and Lawson's administrative costs. Marcus plans to develop the land in five years' time. Required: Discuss how this transaction could be accounted for by Marcus plc. In your answer, consider the legal form of the transaction and its economic substance. (13 marks) (Total: 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts