Question: 2. Based on the strategic group map in Concepts & Connections 3.1. which casual dining chains are Applebee's closest competitors? With which strategic group does

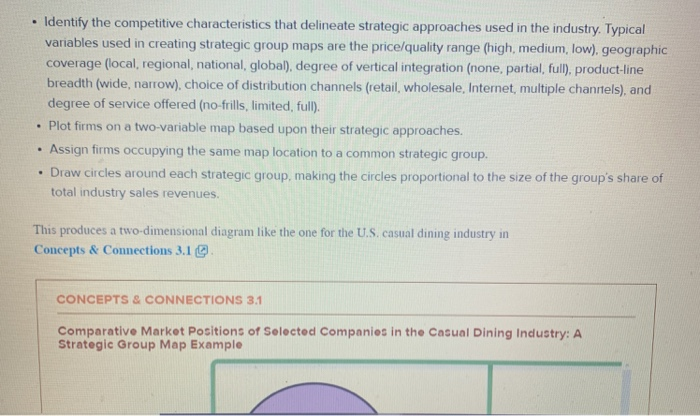

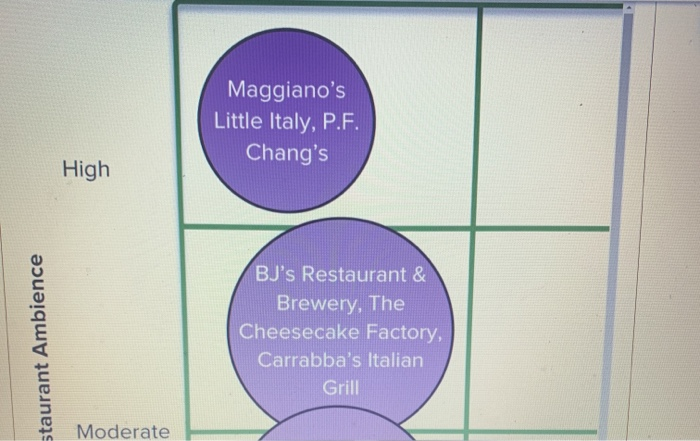

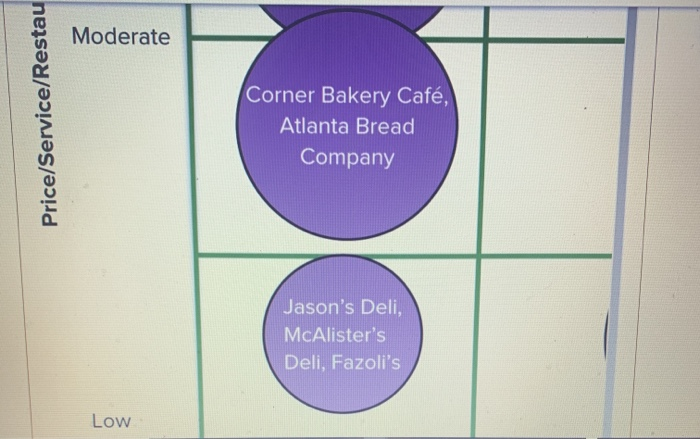

2. Based on the strategic group map in Concepts & Connections 3.1. which casual dining chains are Applebee's closest competitors? With which strategic group does California Pizza Kitchen compete the least, according to this map? Why do you think no casual dining chains are positioned in the area above the Olive Garden's group? LO3-3 Econnect Question 4: How Are Industry Rivals Positioned? The nature of competitive strategy inherently positions LO3-3 companies competing in an industry into strategic Map the market positions of key groups of groups with diverse price/quality ranges, different industry rivals distribution channels, varying product features, and different geographic coverages. The best technique for revealing the market positions of industry competitors is strategic group mapping. This analytical tool is useful for comparing the market positions of industry competitors or for grouping industry combatants into like positions. CORE CONCEPT Strategic group mapping is a technique for displaying the different market or competitive positions that rival firms occupy in the industry Using Strategic Group Maps to Assess the Positioning of Key Competitors A strategic group consists of those industry members with similar competitive approaches and positions in the market. Companies in the same strategic group can resemble one another in any of several ways: they may have comparable product-line breadth, sell in the same price/quality range, emphasize the same distribution channels, use essentially the same product attributes to appeal to similar types of buyers, depend on identical technological Page 55 approaches, or offer buyers similar services and technical assistance. An industry with a commodity-like product may contain only one strategic group whereby all sellers pursue essentially identical strategies and have comparable market positions. But even with commodity products, there is likely some attempt at differentiation occurring in the form of varying delivery times, financing terms, or levels of customer service. Most industries offer a host of competitive approaches that allow companies to find unique industry positioning and avoid fierce competition in a crowded strategic group. Evaluating strategy options entails examining what strategic groups exist, identifying which companies exist within each group, and determining if a competitive "white space" exists where industry competitors are able to create and capture altogether new demand, CORE CONCEPT A strategic group is a cluster of industry rivals that have similar competitive approaches and market positions The procedure for constructing a strategic group map is straightforward: . Identify the competitive characteristics that delineate strategic approaches used in the industry. Typical variables used in creating strategic group maps are the price/quality range (high, medium, low), geographic coverage (local, regional, national, global), degree of vertical integration (none, partial, full), product-line breadth (wide, narrow), choice of distribution channels (retail, wholesale, Internet, multiple chanrtels), and degree of service offered (no-frills, limited, full). Plot firms on a two-variable map based upon their strategic approaches. Assign firms occupying the same map location to a common strategic group. Draw circles around each strategic group, making the circles proportional to the size of the group's share of total industry sales revenues. . This produces a two-dimensional diagram like the one for the U.S. casual dining industry in Concepts & Connections 3.1. CONCEPTS & CONNECTIONS 3.1 Comparative Market Positions of Selected Companies in the Casual Dining Industry: A Strategic Group Map Example Maggiano's Little Italy, P.F. Chang's High staurant Ambience BJ's Restaurant & Brewery, The Cheesecake Factory, Carrabba's Italian Grill Moderate Moderate Price/Service/Restau Corner Bakery Caf, Atlanta Bread Company Jason's Deli, McAlister's Deli, Fazoli's Low Low Few U.S. Locations Note: Circles are drawn roughly proportional to the size of the chains, based on revenues. Several guidelines need to be observed in creating strategic group maps. First, the two variables selected as axes for the map should not be highly correlated: if they are the circles on the map will fall along a diagonal and strategy makers will learn nothing more about the relative positions of competitors than they would by considering just one of the variables. For instance, if companies with broad product lines use multiple distribution channels, while companies with narrow lines use a single distribution channel, then looking at product line-breadth reveals just as much about industry positioning as looking at the two competitive variables. Second, the variables chosen as axes for the map should reflect key approaches to offering value to customers and expose big differences in how rivals position themselves in the marketplace. Third, the variables used as axes do not have to be either quantitative or continuous: rather, they can be discrete variables or defined in terms of distinct classes and combinations. Fourth, drawing the sizes of the circles on the discrete variables or defined in terms of distinct classes and combinations. Fourth, drawing the sizes of the circles on the map proportional to the combined sales of the firms in each strategic group allows the map to reflect the relative sizes of each strategic group. Fifth, if more than two good competitive variables can be used as axes for the map, multiple maps can be drawn to give different exposures to the competitive positioning in the industry. Because there is not necessarily one best map for portraying how competing firms are positioned in the market, it is advisable to experiment with different pairs of competitive variables. Page 56 The Value of Strategic Group Maps Strategic group maps are revealing in several respects. The most important has to do with identifying which rivals are similarly positioned and are thus close rivals and which are distant rivals. Generally, the closer strategic groups are to each other on the map, the stronger the cross-group competitive rivalry tends to be. Although firms in the same strategic group are the closest rivals, the next closest rivals are in the immediately adjacent groups. Often, firms in strategic groups that are far apart on the map hardly compete. For instance, Walmart's clientele, merchandise selection, and pricing points are much too different to justify calling Walmart a close competitor of Neiman Marcus or Saks Fifth Avenue in retailing. For the same reason. Timex is not a meaningful competitive rival of Rolex and Kin is not a Page 57 close competitor of Porsche or BMW Some strategic groups are more favorably positioned than others because they confront weaker competitive forces and/or because they are more favorably impacted by industry driving forces. The second thing to be gleaned from strategic group mapping is that not all positions on the map are equally attractive. Two reasons account for why some positions can be more attractive than others: 1. Industry driving forces may favor some strategic groups and hurt others. Driving forces in an industry may be acting to grow the demand for the products of firms in some strategic groups and shrink the demand for the products of firms in other strategic groups-as is the case in the news industry where Internet news services and cable news networks are gaining ground at the expense of newspapers and network television. The industry driving forces of emerging Internet capabilities and applications, changes in who buys the product and how they use it, and changing societal concerns, attitudes and lifestyles are making it increasingly difficult for traditional media to increase audiences and attract new advertisers. 2. Competitive pressures may cause the profit potential of different strategic groups to vary. The profit prospects of firms in different strategic groups can vary from good to poor because of differing degrees of competitive rivalry within strategic groups, differing degrees of exposure to competition from substitute products outside the industry, and differing degrees of supplier or customer bargaining power from group to group. For instance the competitive battle between Walmart and Target is more intense (with consequently smaller profit margins) than the rivalry among Tory Burch, Carolina Herrera, Dolce & Gabbana and other high-end fashion retailers. be acting to grow the demand for the products of firms in some strategic groups and shrink the demand for the products of firms in other strategic groups-as is the case in the news industry where Internet news services and cable news networks are gaining ground at the expense of newspapers and network television. The industry driving forces of emerging Internet capabilities and applications, changes in who buys the product and how they use it, and changing societal concerns, attitudes, and lifestyles are making it increasingly difficult for traditional media to increase audiences and attract new advertisers. 2. Competitive pressures may cause the profit potential of different strategic groups to vary. The profit prospects of firms in different strategic groups can vary from good to poor because of differing degrees of competitive rivalry within strategic groups, differing degrees of exposure to competition from substitute products outside the industry, and differing degrees of supplier or customer bargaining power from group to group. For instance, the competitive battle between Walmart and Target is more intense (with consequently smaller profit margins) than the rivalry among Tory Burch, Carolina Herrera, Dolce & Gabbana, and other high-end fashion retailers. Thus, part of strategic group analysis always entails drawing conclusions about where on the map is the "best" place to be and why. Which companies or strategic groups are in the best positions to prosper, and which might be expected to struggle? And equally important, how might firms in poorly positioned strategic groups reposition themselves to improve their prospects for good financial performance