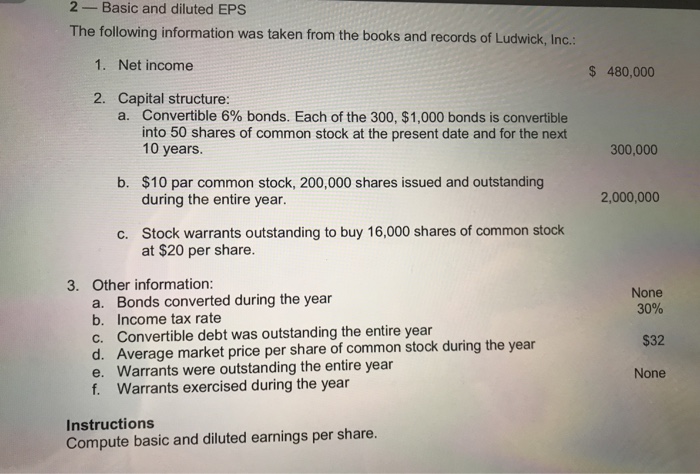

Question: 2 - Basic and diluted EPS The following information was taken from the books and records of Ludwick, Inc. 1. Net income $ 480,000 2.

2 - Basic and diluted EPS The following information was taken from the books and records of Ludwick, Inc. 1. Net income $ 480,000 2. Capital structure: Convertible 6% bonds. Each of the 300, $1,000 bonds is convertible into 50 shares of common stock at the present date and for the next 10 years a. 300,000 $10 par common stock, 200,000 shares issued and outstanding during the entire year. b. 2,000,000 Stock warrants outstanding to buy 16,000 shares of common stock at $20 per share. c. 3. Other information: None a. Bonds converted during the year b. Income tax rate c. Convertible debt was outstanding the entire year d. Average market price per share of common stock during the year e. Warrants were outstanding the entire year f. Warrants exercised during the year 30% $32 None Instructions Compute basic and diluted earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts