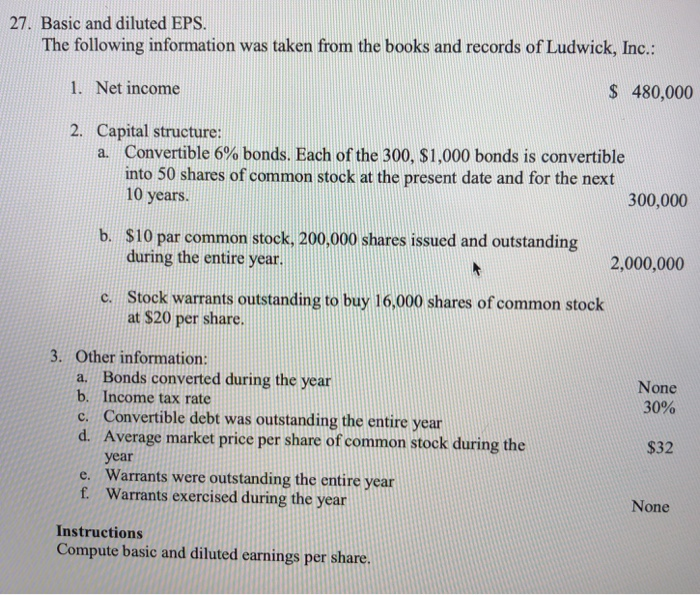

Question: 27. Basic and diluted EPS. The following information was taken from the books and records of Ludwick, Inc.: S 480,000 1. Net income 2. Capital

27. Basic and diluted EPS. The following information was taken from the books and records of Ludwick, Inc.: S 480,000 1. Net income 2. Capital structure: Convertible 6% bonds. Each of the 300, $1,000 bonds is convertible into 50 shares of common stock at the present date and for the next 10 years. 300,000 $10 par common stock, 200.000 shares issued and outstanding during the entire year b. 2,000,000 Stock warrants outstanding to buy 16,000 shares of common stock at $20 per share. c. 3. Other information: None 30% a. Bonds converted during the year b. Income tax rate c. Convertible debt was outstanding the entire year d. Average market price per share of common stock during the $32 year Warrants were outstanding the entire year e. f. Warrants exercised during the year None Instructions Compute basic and diluted earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts