Question: Pr. 13-16-148 Basic and diluted EPS. The following information was taken from the books and records of Ludwick, Inc.: 1. Net income $ 350,000 2.

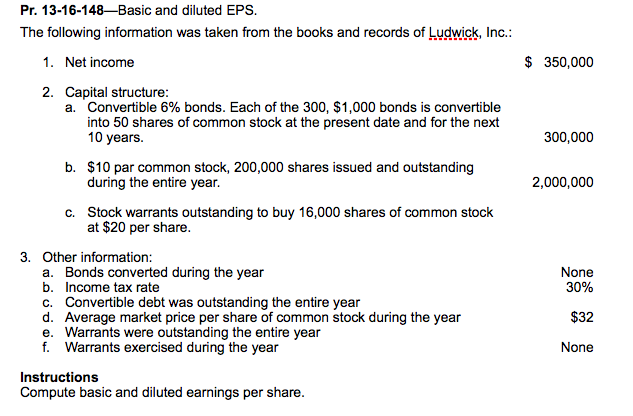

Pr. 13-16-148Basic and diluted EPS.

The following information was taken from the books and records of Ludwick, Inc.:

1. Net income $ 350,000

2. Capital structure:

a. Convertible 6% bonds. Each of the 300, $1,000 bonds is convertible

into 50 shares of common stock at the present date and for the next

10 years. 300,000

b. $10 par common stock, 200,000 shares issued and outstanding

during the entire year. 2,000,000

c. Stock warrants outstanding to buy 16,000 shares of common stock

at $20 per share.

3. Other information:

a. Bonds converted during the year None

b. Income tax rate 30%

c. Convertible debt was outstanding the entire year

d. Average market price per share of common stock during the year $32

e. Warrants were outstanding the entire year

f. Warrants exercised during the year None

Instructions

Compute basic and diluted earnings per share.

Pr. 13-16-148-Basic and diluted EPS. The following information was taken from the books and records of Ludwick, Inc.: 1. Net income 2. Capital structure: a. Convertible 6% bonds. Each of the 300, $1,000 bonds is convertible into 50 shares of common stock at the present date and for the next 10 years. b. $10 par common stock, 200,000 shares issued and outstanding during the entire year. c. Stock warrants outstanding to buy 1 6,000 shares of common stock at $20 per share. 3. Other information: a. Bonds converted during the year b. ncome tax rate c. Convertible debt was outstanding the entire year d. Average market price per share of common stock during the year e. Warrants were outstanding the entire year Warrants exercised during the year Instructions Compute basic and diluted earnings per share. 350,000 300,000 2,000,000 None 30% $32 None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts