Question: 2. Briefly answer the following questions, a) Why does the probability of default estimated with KMV model react quickly to the changes in the level

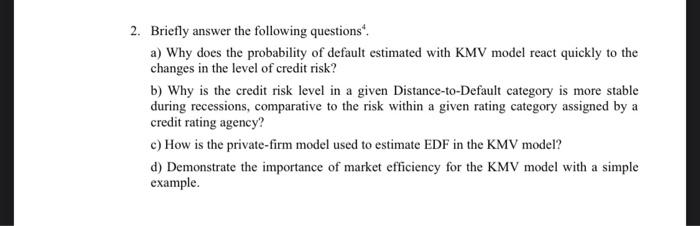

2. Briefly answer the following questions, a) Why does the probability of default estimated with KMV model react quickly to the changes in the level of credit risk? b) Why is the credit risk level in a given Distance-to-Default category is more stable during recessions, comparative to the risk within a given rating category assigned by a credit rating agency? c) How is the private-firm model used to estimate EDF in the KMV model? d) Demonstrate the importance of market efficiency for the KMV model with a simple example. 2. Briefly answer the following questions, a) Why does the probability of default estimated with KMV model react quickly to the changes in the level of credit risk? b) Why is the credit risk level in a given Distance-to-Default category is more stable during recessions, comparative to the risk within a given rating category assigned by a credit rating agency? c) How is the private-firm model used to estimate EDF in the KMV model? d) Demonstrate the importance of market efficiency for the KMV model with a simple example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts