Question: 2. By using data from Table #1 find the forward premium on Foreign Currency in % (Round your answer to 4 decimals). . 9.1209

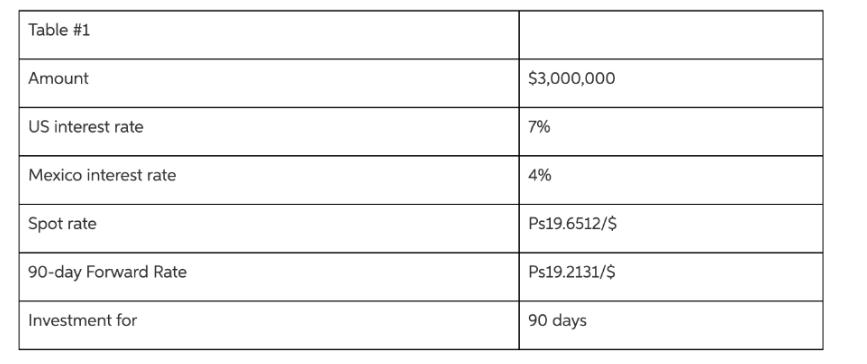

2. By using data from Table #1 find the forward premium on Foreign Currency in % (Round your answer to 4 decimals). . 9.1209 3. By using data from Table #1 find the CIA profit potemtial in % (Round your answer to 4 decimals) 6.1209 . 4. By using data from Table #1 what currency do you need to invest to generate arbitrage profit, according to the rule of thumb? . Ps 5. By using data from Table #1, find the total proceeds (principal + interest income) of the investment for 90 days in the currency according to the rule of thumb (this is the amount that you will sell forward). 6. By using data from Table #1, find the total opportunity cost of capital (Hint: find proceeds of 90-day investment in a second currency: principal + interest income). 7. By using data from Table #1, find the CIA profit (after accounting for the opportunity cost of capital; do not round intermediate calculations; Round your final answer to the nearest US dollar). Table #1 Amount $3,000,000 7% US interest rate Mexico interest rate Spot rate 90-day Forward Rate Investment for 4% Ps19.6512/$ Ps19.2131/$ 90 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts