Question: 2. CAPPED CALL/PUT OPTION UNDER N-PERIOD BINOMIAL MODEL (20 POINTS) A capped call option has the payoff at the expiry T below: min(max(SK,0),H) where H0

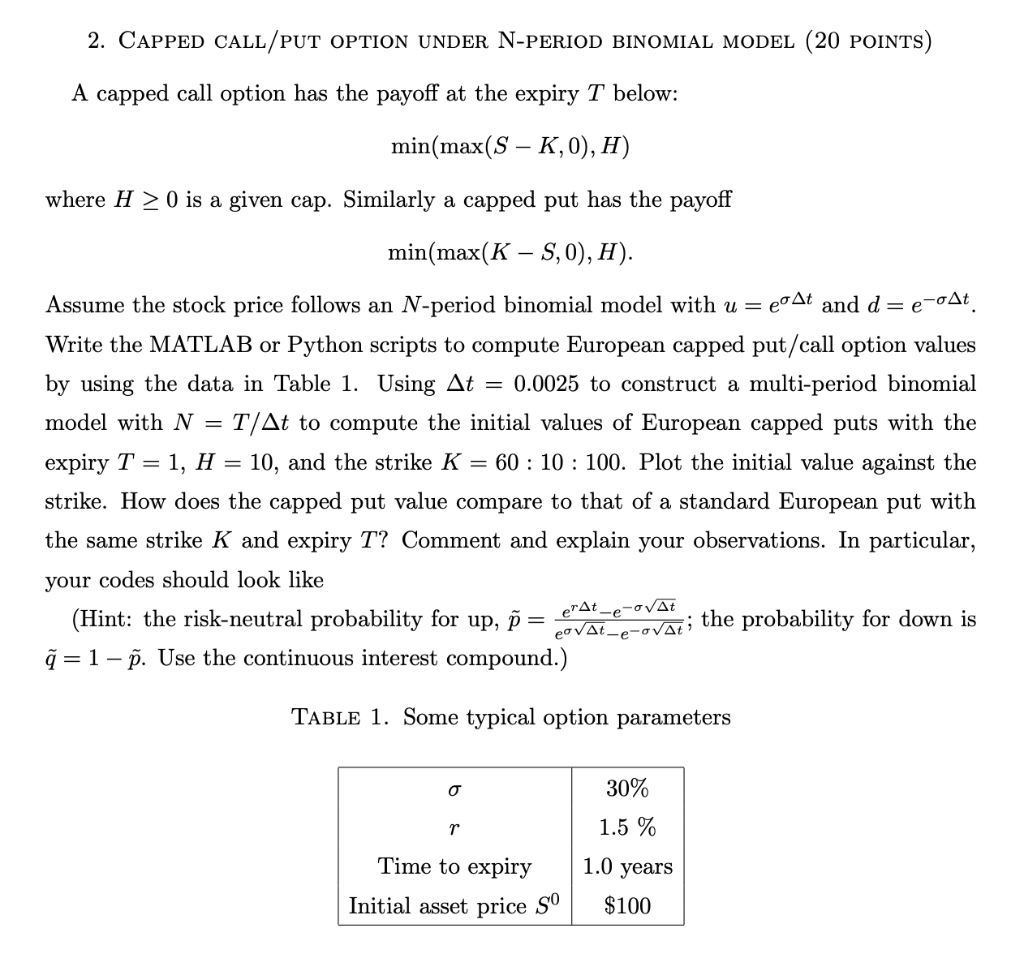

2. CAPPED CALL/PUT OPTION UNDER N-PERIOD BINOMIAL MODEL (20 POINTS) A capped call option has the payoff at the expiry T below: min(max(SK,0),H) where H0 is a given cap. Similarly a capped put has the payoff min(max(KS,0),H). Assume the stock price follows an N-period binomial model with u=et and d=et. Write the MATLAB or Python scripts to compute European capped put/call option values by using the data in Table 1 . Using t=0.0025 to construct a multi-period binomial model with N=T/t to compute the initial values of European capped puts with the expiry T=1,H=10, and the strike K=60:10:100. Plot the initial value against the strike. How does the capped put value compare to that of a standard European put with the same strike K and expiry T ? Comment and explain your observations. In particular, your codes should look like (Hint: the risk-neutral probability for up, p~=etetertet; the probability for down is q~=1p~. Use the continuous interest compound.) 2. CAPPED CALL/PUT OPTION UNDER N-PERIOD BINOMIAL MODEL (20 POINTS) A capped call option has the payoff at the expiry T below: min(max(SK,0),H) where H0 is a given cap. Similarly a capped put has the payoff min(max(KS,0),H). Assume the stock price follows an N-period binomial model with u=et and d=et. Write the MATLAB or Python scripts to compute European capped put/call option values by using the data in Table 1 . Using t=0.0025 to construct a multi-period binomial model with N=T/t to compute the initial values of European capped puts with the expiry T=1,H=10, and the strike K=60:10:100. Plot the initial value against the strike. How does the capped put value compare to that of a standard European put with the same strike K and expiry T ? Comment and explain your observations. In particular, your codes should look like (Hint: the risk-neutral probability for up, p~=etetertet; the probability for down is q~=1p~. Use the continuous interest compound.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts