Question: 2. Consider a Binomial Model with T = 2, r = 1.5, So = 90, d = 1 /3, u = 4, and p =

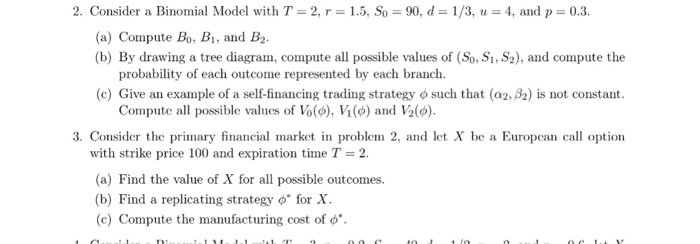

2. Consider a Binomial Model with T = 2, r = 1.5, So = 90, d = 1 /3, u = 4, and p = 0.3. (a) Compute Bo, Bi, and B2 (b) By drawing a tree diagram, compute all possible values of (So, S1, S2), and compute the probability of each outcome represented by each branch (c) Give an example of a self-financing trading strategy such that (02.32) is not constant. Compute all possible values of Vo(c), Vi(d) and (d) 3. Consider the primary financial market in problem 2, and let X be a Europcan call option with strike price 100 and expiration time T = 2. (a) Find the value of X for all possible outcomes. (b) Find a replicating strategy . for X. (c) Compute the manufacturing cost of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts