Question: = 2 = = = = Exercise 1.18. Consider a financial model with two times, t = 0 and t = 1, and a single

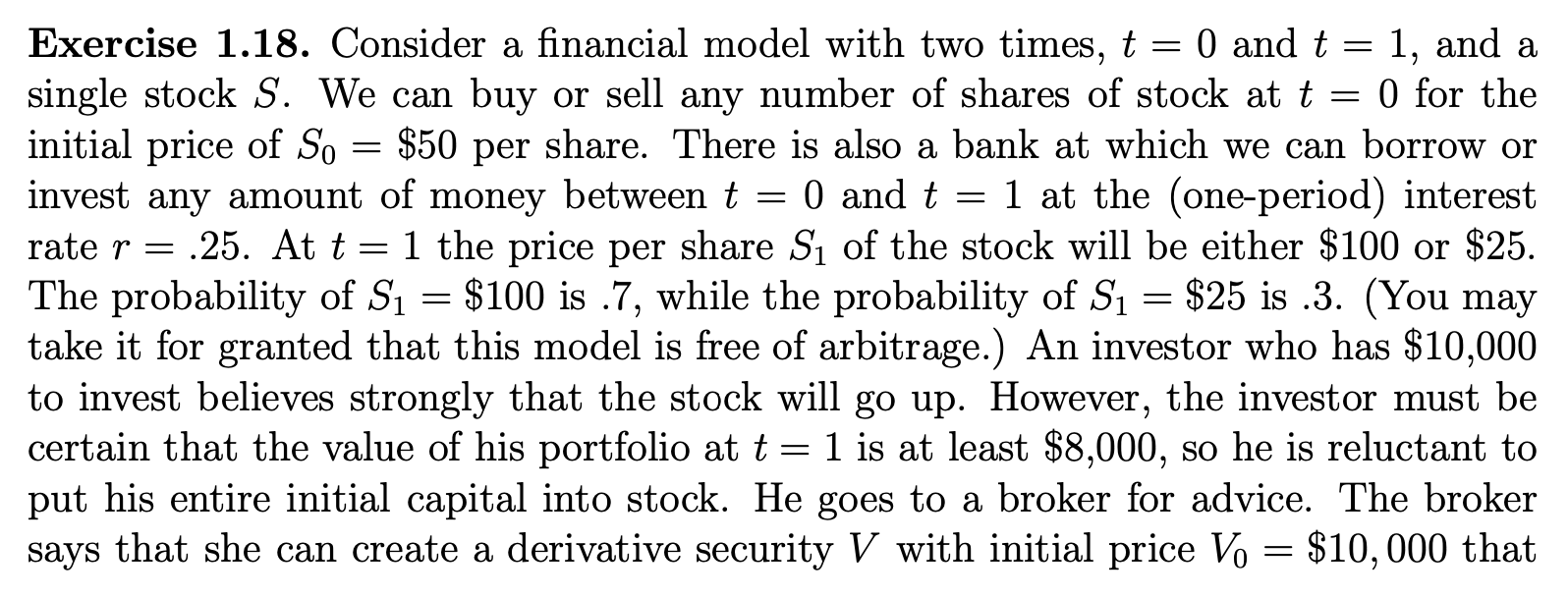

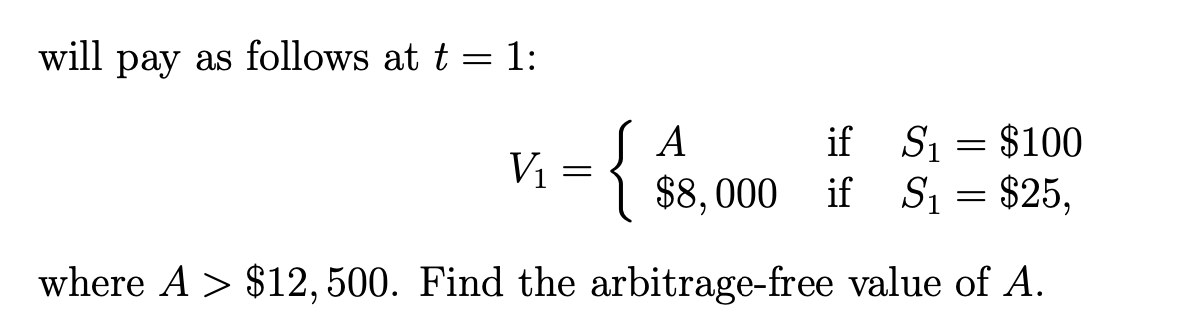

= 2 = = = = Exercise 1.18. Consider a financial model with two times, t = 0 and t = 1, and a single stock S. We can buy or sell any number of shares of stock at t O for the initial price of So $50 per share. There is also a bank at which we can borrow or invest any amount of money between t = 0 and t = 1 at the (one-period) interest O 1 - rate r = .25. At t=1 the price per share Sy of the stock will be either $100 or $25. The probability of S1 = $100 is . 7, while the probability of S1 = $25 is .3. (You may take it for granted that this model is free of arbitrage.) An investor who has $10,000 to invest believes strongly that the stock will go up. However, the investor must be certain that the value of his portfolio at t=1 is at least $8,000, so he is reluctant to , put his entire initial capital into stock. He goes to a broker for advice. The broker says that she can create a derivative security V with initial price Vo = $10,000 that 7 = = will pay as follows at t = 1: Vi= - {s. A $8,000 if Si = $100 if Si = $25, = where A > $12,500. Find the arbitrage-free value of A. = 2 = = = = Exercise 1.18. Consider a financial model with two times, t = 0 and t = 1, and a single stock S. We can buy or sell any number of shares of stock at t O for the initial price of So $50 per share. There is also a bank at which we can borrow or invest any amount of money between t = 0 and t = 1 at the (one-period) interest O 1 - rate r = .25. At t=1 the price per share Sy of the stock will be either $100 or $25. The probability of S1 = $100 is . 7, while the probability of S1 = $25 is .3. (You may take it for granted that this model is free of arbitrage.) An investor who has $10,000 to invest believes strongly that the stock will go up. However, the investor must be certain that the value of his portfolio at t=1 is at least $8,000, so he is reluctant to , put his entire initial capital into stock. He goes to a broker for advice. The broker says that she can create a derivative security V with initial price Vo = $10,000 that 7 = = will pay as follows at t = 1: Vi= - {s. A $8,000 if Si = $100 if Si = $25, = where A > $12,500. Find the arbitrage-free value of A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts