Question: a - = = = 5(2) = = = = Exercise 1.20. Consider a financial model with two times, t= 0 and t 1, and

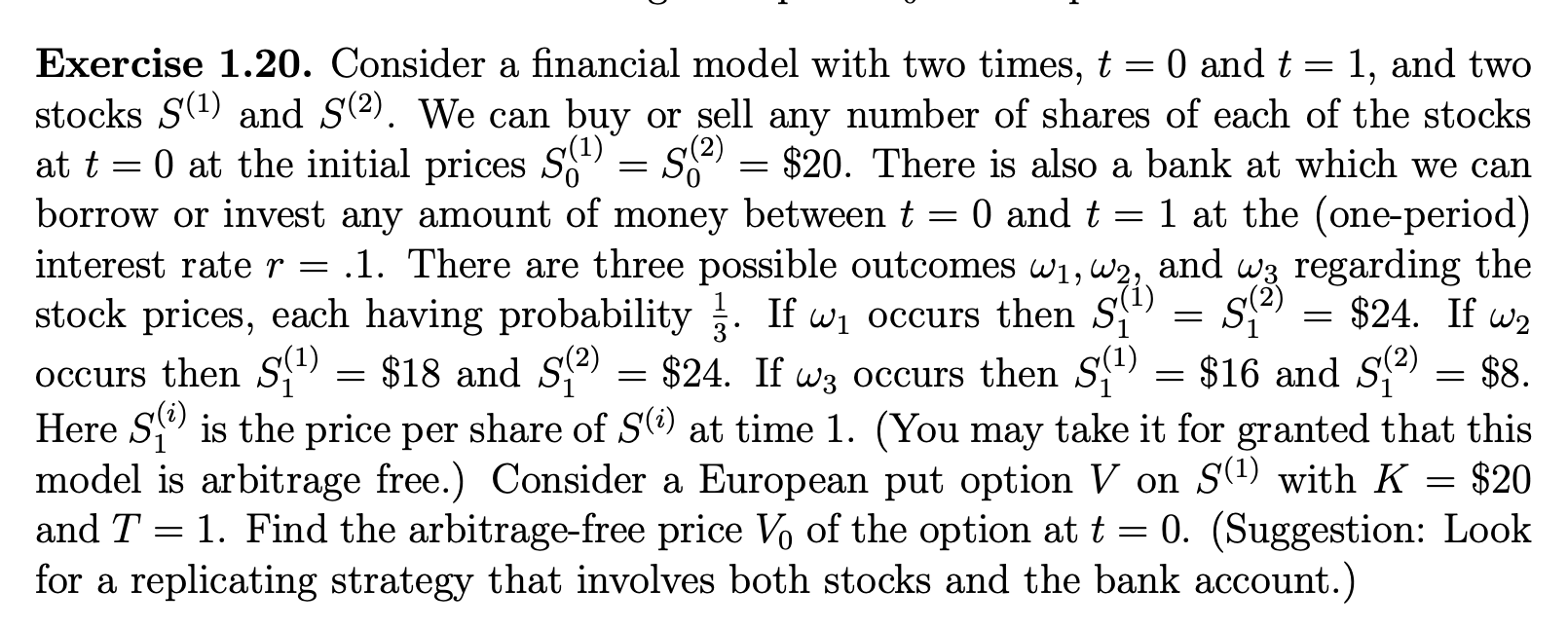

a - = = = 5(2) = = = = Exercise 1.20. Consider a financial model with two times, t= 0 and t 1, and two stocks S(1) and S(2). We can buy or sell any number of shares of each of the stocks at t = 0) at the initial prices si $20. There is also a bank at which we can borrow or invest any amount of money between t = 0 and t = 1 at the (one-period) interest rate r = .1. There are three possible outcomes w1, W2, and wz regarding the ) stock prices, each having probability. If wi occurs then s y(2) S2) S $24. If w2 occurs then s(1) = $18 and S(2) = $24. If wz occurs then s) S $S? = $16 and S(2) = $8. = $ Here is the price per share of S(i) at time 1. (You may take it for granted that this (i) model is arbitrage free.) Consider a European put option V on S(1) with K = $20 and T = 1. Find the arbitrage-free price V of the option at t = 0. (Suggestion: Look for a replicating strategy that involves both stocks and the bank account.) = = = = a - = = = 5(2) = = = = Exercise 1.20. Consider a financial model with two times, t= 0 and t 1, and two stocks S(1) and S(2). We can buy or sell any number of shares of each of the stocks at t = 0) at the initial prices si $20. There is also a bank at which we can borrow or invest any amount of money between t = 0 and t = 1 at the (one-period) interest rate r = .1. There are three possible outcomes w1, W2, and wz regarding the ) stock prices, each having probability. If wi occurs then s y(2) S2) S $24. If w2 occurs then s(1) = $18 and S(2) = $24. If wz occurs then s) S $S? = $16 and S(2) = $8. = $ Here is the price per share of S(i) at time 1. (You may take it for granted that this (i) model is arbitrage free.) Consider a European put option V on S(1) with K = $20 and T = 1. Find the arbitrage-free price V of the option at t = 0. (Suggestion: Look for a replicating strategy that involves both stocks and the bank account.) = = = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts