Question: 2. Given the information in Problem 1, draw the Security Market Line. Clearly label all the important parts of the graph. a) Where do common

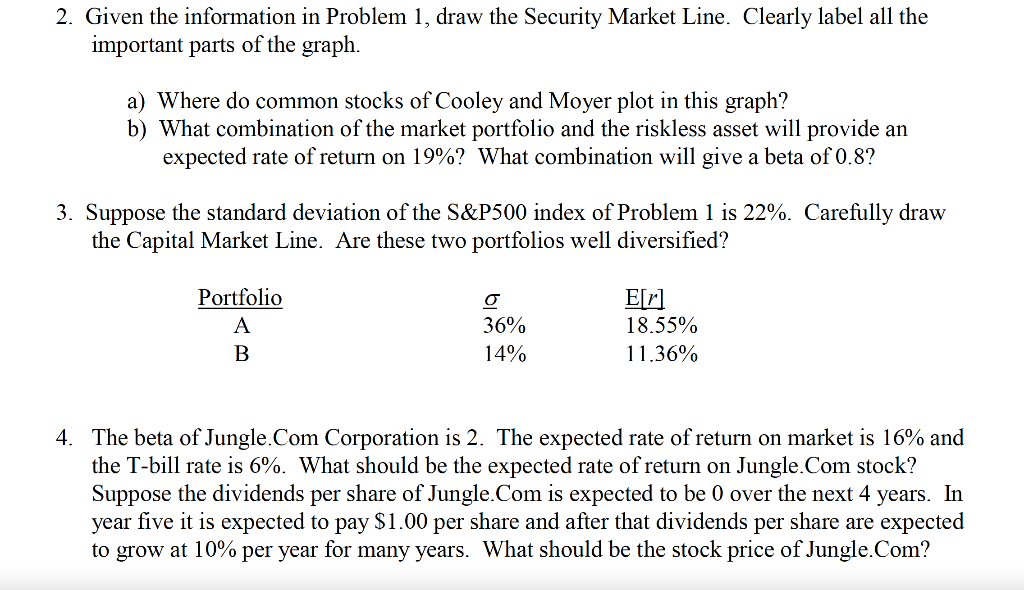

2. Given the information in Problem 1, draw the Security Market Line. Clearly label all the important parts of the graph. a) Where do common stocks of Cooley and Moyer plot in this graph? b) What combination of the market portfolio and the riskless asset will provide an expected rate of return on 19%? What combination will give a beta of 0.8? 3. Suppose the standard deviation of the S&P500 index of Problem 1 is 22%. Carefully draw the Capital Market Line. Are these two portfolios well diversified? Portfolio A B o 36% 14% E[r] 18.55% 11.36% 4. The beta of Jungle.Com Corporation is 2. The expected rate of return on market is 16% and the T-bill rate is 6%. What should be the expected rate of return on Jungle.Com stock? Suppose the dividends per share of Jungle.Com is expected to be 0 over the next 4 years. In year five it is expected to pay $1.00 per share and after that dividends per share are expected to grow at 10% per year for many years. What should be the stock price of Jungle.Com? 2. Given the information in Problem 1, draw the Security Market Line. Clearly label all the important parts of the graph. a) Where do common stocks of Cooley and Moyer plot in this graph? b) What combination of the market portfolio and the riskless asset will provide an expected rate of return on 19%? What combination will give a beta of 0.8? 3. Suppose the standard deviation of the S&P500 index of Problem 1 is 22%. Carefully draw the Capital Market Line. Are these two portfolios well diversified? Portfolio A B o 36% 14% E[r] 18.55% 11.36% 4. The beta of Jungle.Com Corporation is 2. The expected rate of return on market is 16% and the T-bill rate is 6%. What should be the expected rate of return on Jungle.Com stock? Suppose the dividends per share of Jungle.Com is expected to be 0 over the next 4 years. In year five it is expected to pay $1.00 per share and after that dividends per share are expected to grow at 10% per year for many years. What should be the stock price of Jungle.Com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts