Question: 2. Investment timing options Aa Aa E Companies often need to choose between making an investment now or waiting till the company can gather more

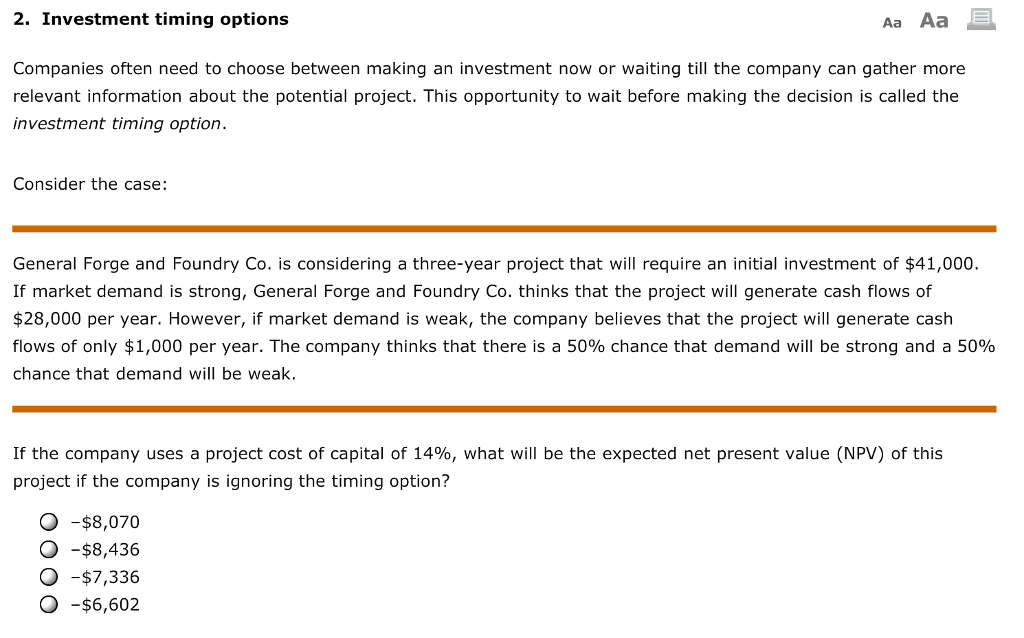

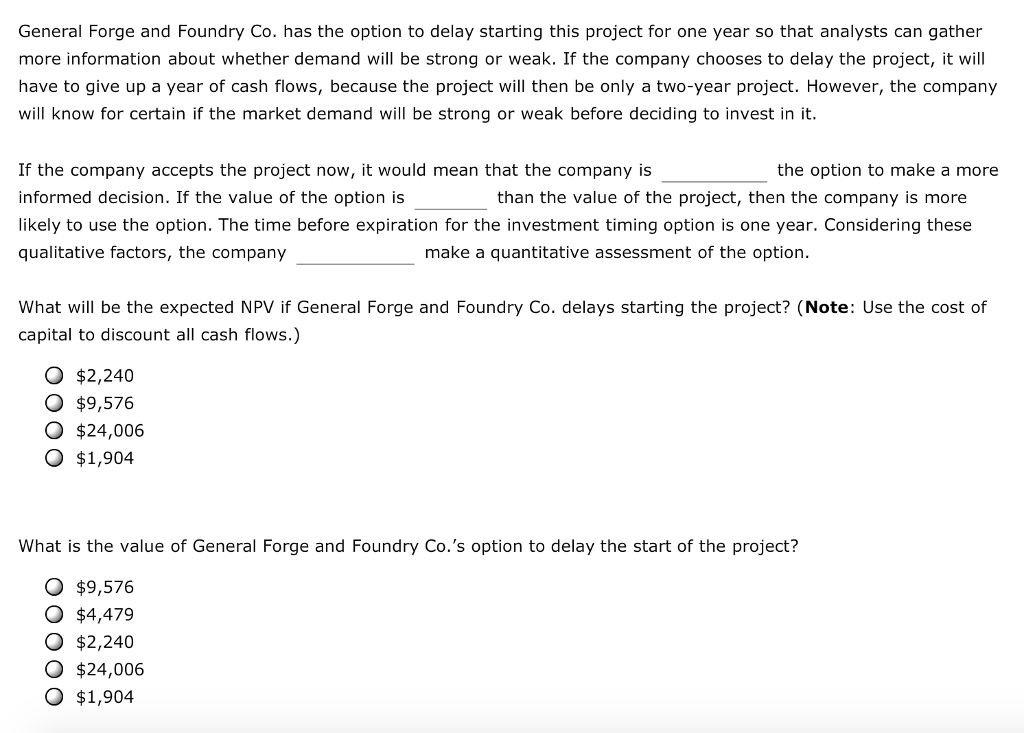

2. Investment timing options Aa Aa E Companies often need to choose between making an investment now or waiting till the company can gather more relevant information about the potential project. This opportunity to wait before making the decision is called the investment timing option. Consider the case: General Forge and Foundry Co. is considering a three-year project that will require an initial investment of $41,000. If market demand is strong, General Forge and Foundry Co. thinks that the project will generate cash flows of $28,000 per year. However, if market demand is weak, the company believes that the project will generate cash flows of only $1,000 per year. The company thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 14%, what will be the expected net present value (NPV) of this project if the company is ignoring the timing option? O -$8,070 O -$8,436 O -$7,336 O -$6,602

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts