Question: 2) On January 1, a company issues bonds dated January 1 with a par value of $420,000. The bonds mature in 5 years. The contract

| 2) On January 1, a company issues bonds dated January 1 with a par value of $420,000. The bonds mature in 5 years. The contract rate is 9%, and interest is paid semiannually on June 30 and December 31. The market rate is 10% and the bonds are sold for $403,778. The journal entry to record the first interest payment using straight-line amortization is: A) Debit Interest Payable $18,900.00; credit Cash $18,900.00. B) Debit Interest Expense $20,522.20; credit Discount on Bonds Payable $1,622.20; credit Cash $18,900.00. c) Debit Interest Expense $20,522.20; credit Premium on Bonds Payable $1,622.20; credit Cash $18,900.00. D) Debit Interest Expense $17,277.80; debit Discount on Bonds Payable $1,622.20; credit Cash $18,900.00. E) Debit Interest Expense $18,900.00; credit Cash $18,900.00. |

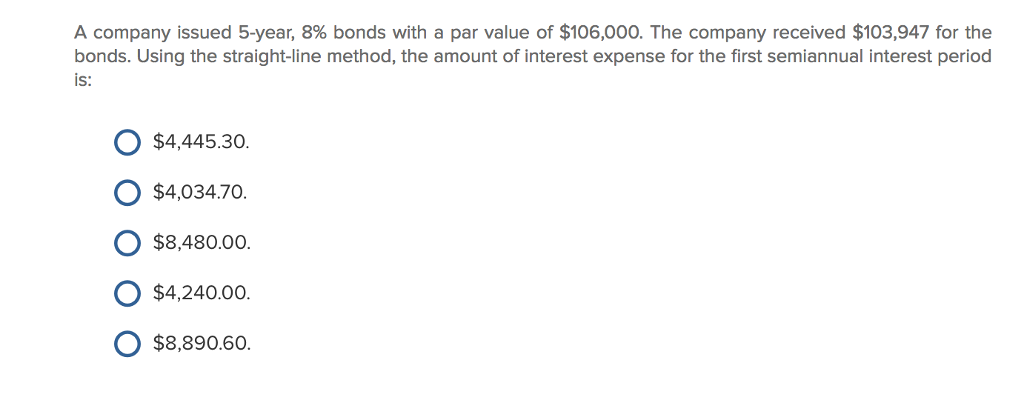

A company issued 5-year, 8% bonds with a par value of $106,000. The company received $103,947 for the bonds. Using the straight-line method, the amount of interest expense for the first semiannual interest period is: O $4,445.30 O $4,034.70. O $8,480.00. O $4,240.00. O $8,890.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts