Question: 2 Points each question (10 Points Total) Q) Suppose a firm has 35.90 million shares of common stock outstanding at a price of $38.21 per

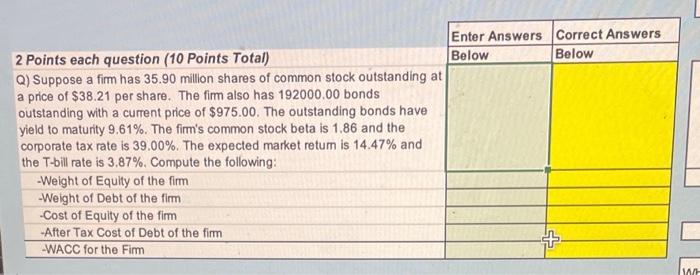

2 Points each question (10 Points Total) Q) Suppose a firm has 35.90 million shares of common stock outstanding at a price of \$38.21 per share. The firm also has 192000.00 bonds outstanding with a current price of $975.00. The outstanding bonds have yield to maturity 9.61%. The firm's common stock beta is 1.86 and the corporate tax rate is 39.00%. The expected market retum is 14.47% and the T-bill rate is 3.87%. Compute the following: \begin{tabular}{l} -Weight of Equity of the firm \\ -Weight of Debt of the firm \\ -Cost of Equity of the firm \\ -After Tax Cost of Debt of the firm \\ \hline -WACC for the Firm \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts