Question: Points as marked - 10 QUESTIONS TOTAL Q1) Suppose a firm has 34.60 million shares of common stock outstanding at a price of $39.09 per

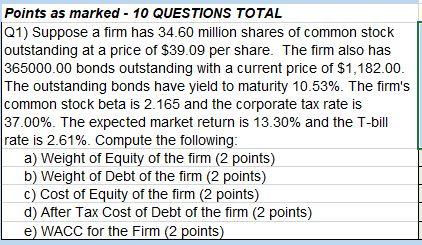

Points as marked - 10 QUESTIONS TOTAL Q1) Suppose a firm has 34.60 million shares of common stock outstanding at a price of $39.09 per share. The firm also has 365000.00 bonds outstanding with a current price of $1,182.00. The outstanding bonds have yield to maturity 10.53%. The firm's common stock beta is 2.165 and the corporate tax rate is 37.00%. The expected market return is 13.30% and the T-bill rate is 2.61%. Compute the following: a) Weight of Equity of the firm (2 points) b) Weight of Debt of the firm (2 points) c) Cost of Equity of the firm (2 points) d) After Tax Cost of Debt of the firm (2 points) e) WACC for the Firm (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts