Question: 2 Problem Set i Saved Help Save & Ex Che Consider historical data showing that the average annual rate of return on the S&P 500

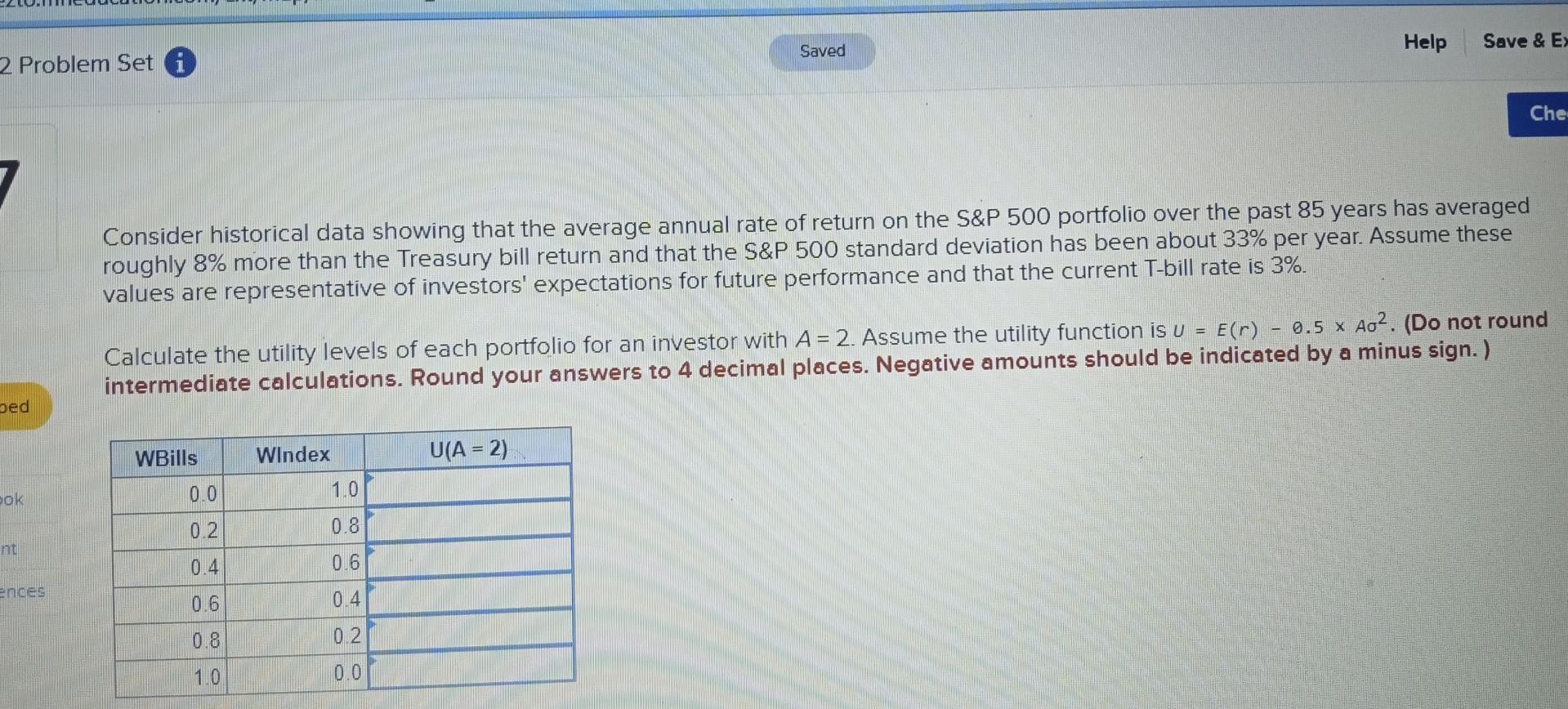

2 Problem Set i Saved Help Save & Ex Che Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 33% per year. Assume these values are representative of investors' expectations for future performance and that the current T-bill rate is 3%. E(r) - 0.5 x Ao2. (Do not round Calculate the utility levels of each portfolio for an investor with A = 2. Assume the utility function is u = intermediate calculations. Round your answers to 4 decimal places. Negative amounts should be indicated by a minus sign.) bed WBills Windex U(A = 2) pok nt ences 0.0 0.2 0.4 0.6 0.8 1.0 1.0 0.8 0.6 0.4 0.2 0.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts