Question: 2 pts Question 8 Sharon, a single individual, properly qualifies to claim her mother as a dependent and pays for over 50% of the cost

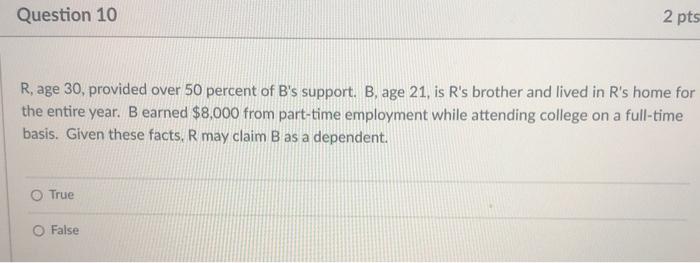

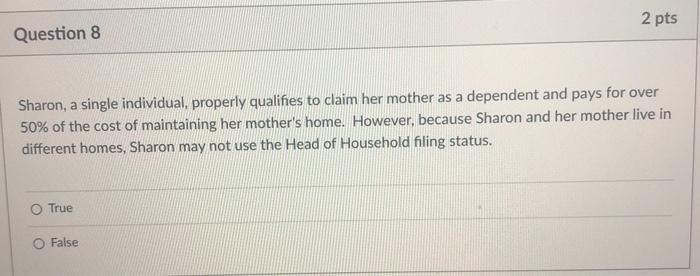

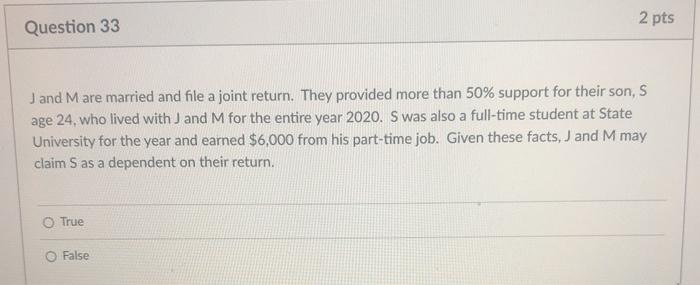

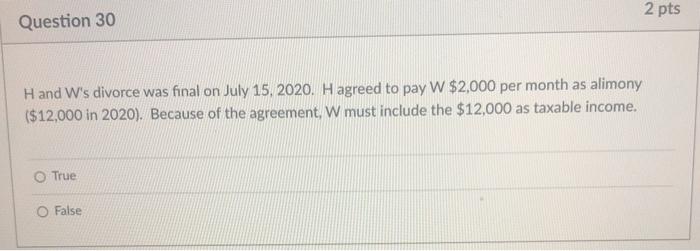

2 pts Question 8 Sharon, a single individual, properly qualifies to claim her mother as a dependent and pays for over 50% of the cost of maintaining her mother's home. However, because Sharon and her mother live in different homes, Sharon may not use the Head of Household filing status. True False 2 pts Question 33 J and M are married and file a joint return. They provided more than 50% support for their son, S age 24, who lived with and M for the entire year 2020. S was also a full-time student at State University for the year and earned $6,000 from his part-time job. Given these facts, J and M may claim S as a dependent on their return. True False 2 pts Question 30 Hand W's divorce was final on July 15, 2020. Hagreed to pay W $2,000 per month as alimony ($12,000 in 2020). Because of the agreement, W must include the $12,000 as taxable income. True O False Question 28 2 pts Generally, if an employee is reimbursed for employee business expenses, the expenses may be claimed as a deduction "for" AGI, if the employer included the reimbursement in the employee's income. True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts