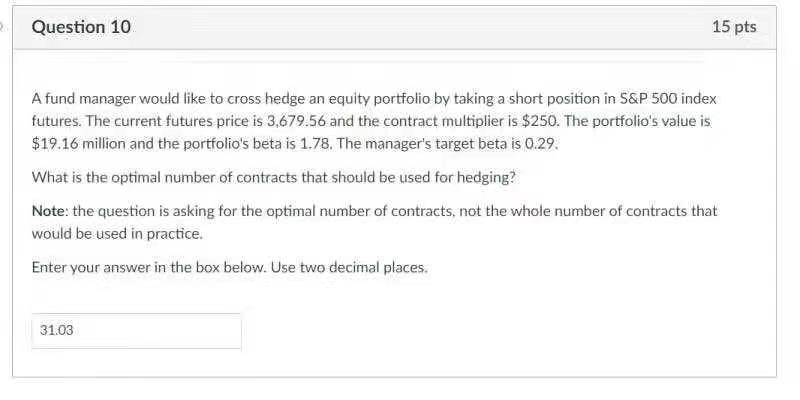

Question: 2 Question 10 15 pts A fund manager would like to cross hedge an equity portfolio by taking a short position in S&P 500 index

2 Question 10 15 pts A fund manager would like to cross hedge an equity portfolio by taking a short position in S&P 500 index futures. The current futures price is 3.679.56 and the contract multiplier is $250. The portfolio's value is $19.16 million and the portfolio's beta is 1.78. The manager's target beta is 0.29. What is the optimal number of contracts that should be used for hedging? Note: the question is asking for the optimal number of contracts, not the whole number of contracts that would be used in practice. Enter your answer in the box below. Use two decimal places. 31.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts