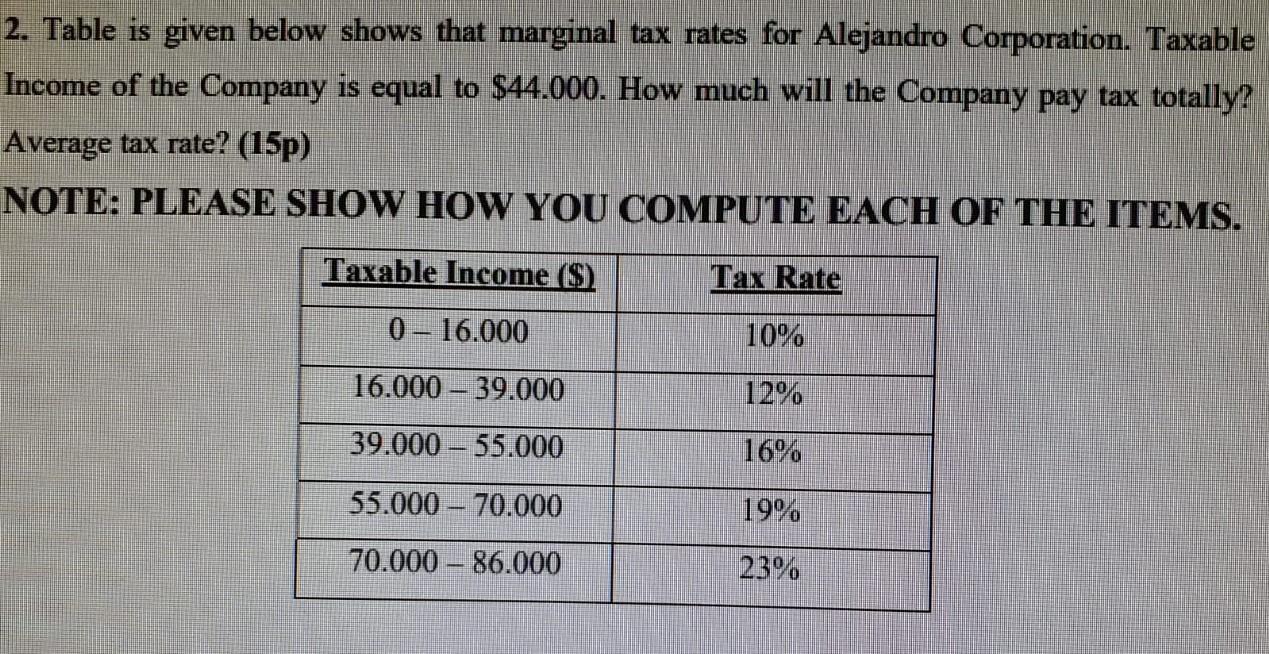

Question: 2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will

2. Table is given below shows that marginal tax rates for Alejandro Corporation. Taxable Income of the Company is equal to $44.000. How much will the Company pay tax totally? Average tax rate? (15p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. Taxable Income (S) Tax Rate 0 - 16.000 10% 16.000 39.000 12% 39.000 55.000 16% 55.000 - 70.000 19% 70.000 - 86.000 23%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock