Question: 2. The binomial interest rate tree for valuing a bond with a maturity of up to four years is shown below. Attach/show your work a]

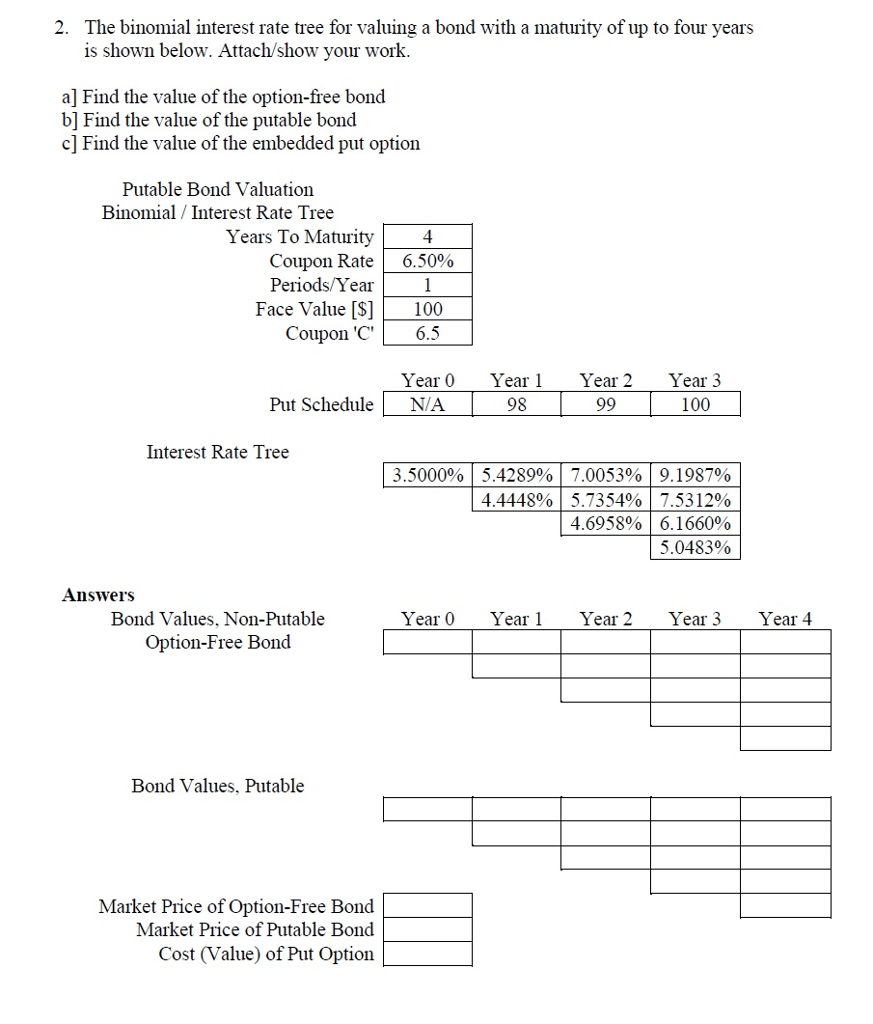

2. The binomial interest rate tree for valuing a bond with a maturity of up to four years is shown below. Attach/show your work a] Find the value of the option-free bond b] Find the value of the putable bond c] Find the value of the embedded put option Putable Bond Valuation Binomial Interest Rate Tree Years To Maturity4 Coupon Rate | 6.50% Periods/Year Face Value [$]100 Coupon 'C6.5 Year 0 Year Year 2 Year3 100 Put ScheduleN/A 98 Interest Rate Tree 3.5000% | 5.4289% | 7.0053% | 9.1987% 4.4448% | 5.7354% | 7.5312% 4.69580 6.166000 5.0483% Answers Bond Values. Non-Putable Option-Free Bond Year 0 YearYear 2 Year 3 Year 4 Bond Values. Putable Market Price of Option-Free Bond Market Price of Putable Bond Cost (Value) of Put Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts