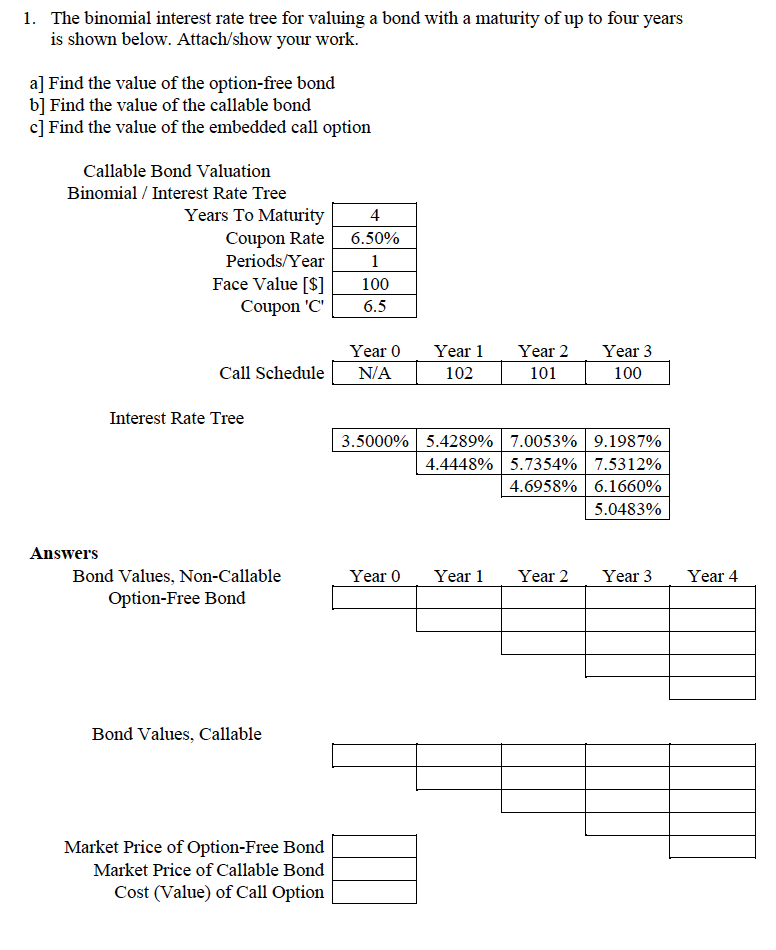

Question: The binomial interest rate tree for valuing a bond with a maturity of up to four years is shown below. Attach/show your work. 1. a]

The binomial interest rate tree for valuing a bond with a maturity of up to four years is shown below. Attach/show your work. 1. a] Find the value of the option-free bond b] Find the value of the callable bond c] Find the value of the embedded call option Callable Bond Valuation Binomial Interest Rate Tree Years To Maturity Coupon Rate 4 6.50% Periods/Year 1 Face Value [$] Coupon 'C 100 6.5 Year 0 Year 1 Year 2 Year 3 Call Schedule N/A 102 101 100 Interest Rate Tree 3.5000%5.4289%|7.0053%|9.1987% 4.4448%5.7354% |7.5312% 4.6958%6.1660% 5.0483% Answers Bond Values, Non-Callable Year 3 Year 4 Year 0 Year 1 Year 2 Option-Free Bond Bond Values, Callable Market Price of Option-Free Bond Market Price of Callable Bond Cost (Value) of Call Option The binomial interest rate tree for valuing a bond with a maturity of up to four years is shown below. Attach/show your work. 1. a] Find the value of the option-free bond b] Find the value of the callable bond c] Find the value of the embedded call option Callable Bond Valuation Binomial Interest Rate Tree Years To Maturity Coupon Rate 4 6.50% Periods/Year 1 Face Value [$] Coupon 'C 100 6.5 Year 0 Year 1 Year 2 Year 3 Call Schedule N/A 102 101 100 Interest Rate Tree 3.5000%5.4289%|7.0053%|9.1987% 4.4448%5.7354% |7.5312% 4.6958%6.1660% 5.0483% Answers Bond Values, Non-Callable Year 3 Year 4 Year 0 Year 1 Year 2 Option-Free Bond Bond Values, Callable Market Price of Option-Free Bond Market Price of Callable Bond Cost (Value) of Call Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts