Question: 2. To evaluate a mutual fund, you adopt two different benchmark models: a single-index model and the Fama-French three-factor model. The monthly historical excess return

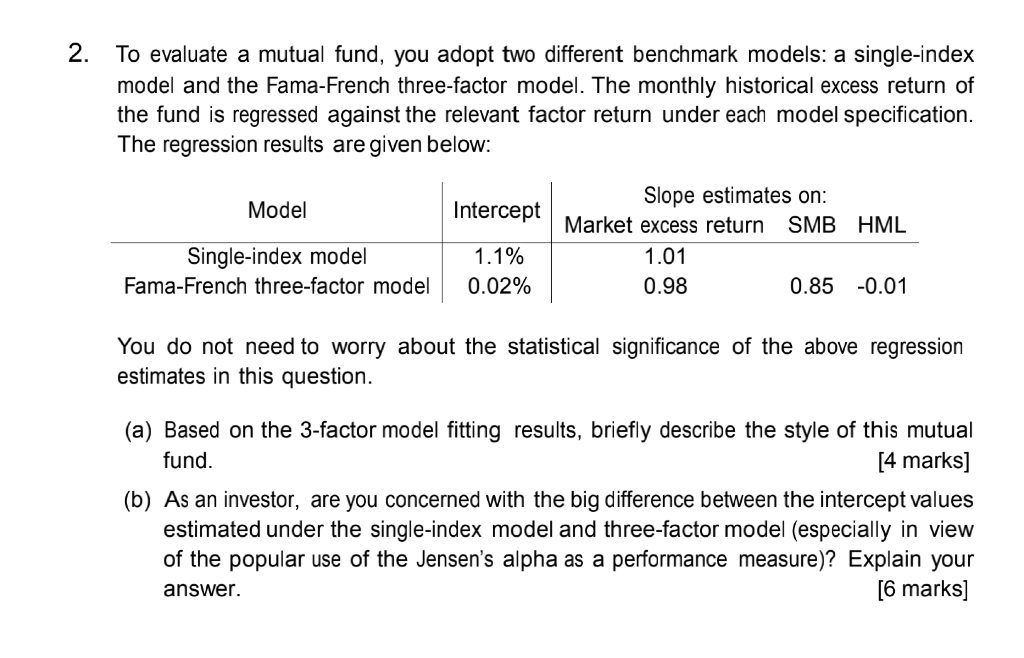

2. To evaluate a mutual fund, you adopt two different benchmark models: a single-index model and the Fama-French three-factor model. The monthly historical excess return of the fund is regressed against the relevant factor return under each model specification. The regression results are given below: Model Intercept Slope estimates on: Market excess return SMB HML 1.01 0.98 0.85 -0.01 Single-index model Fama-French three-factor model 1.1% 0.02% You do not need to worry about the statistical significance of the above regression estimates in this question. (a) Based on the 3-factor model fitting results, briefly describe the style of this mutual fund. [4 marks] (b) As an investor, are you concerned with the big difference between the intercept values estimated under the single-index model and three-factor model (especially in view of the popular use of the Jensen's alpha as a performance measure)? Explain your answer. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts