Question: (a) Based on the 3-factor model fitting results, briefly describe the style of this mutual fund (b) As an investor, are you concerned with the

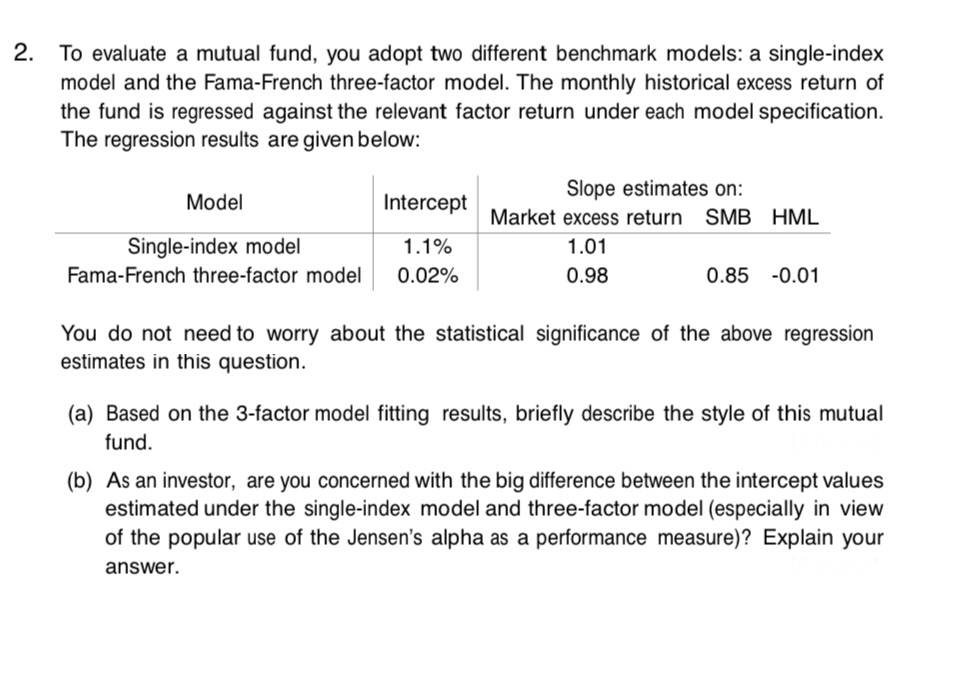

(a) Based on the 3-factor model fitting results, briefly describe the style of this mutual fund

(b) As an investor, are you concerned with the big difference between the intercept values estimated under the single-index model and three-factor model (especially in view of the popular use of the Jensen's alpha as a performance measure)? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts