Question: 2. To evaluate a mutual fund, you adopt two different benchmark models: a single-index model and the Fama-French three-factor model. The monthly historical excess

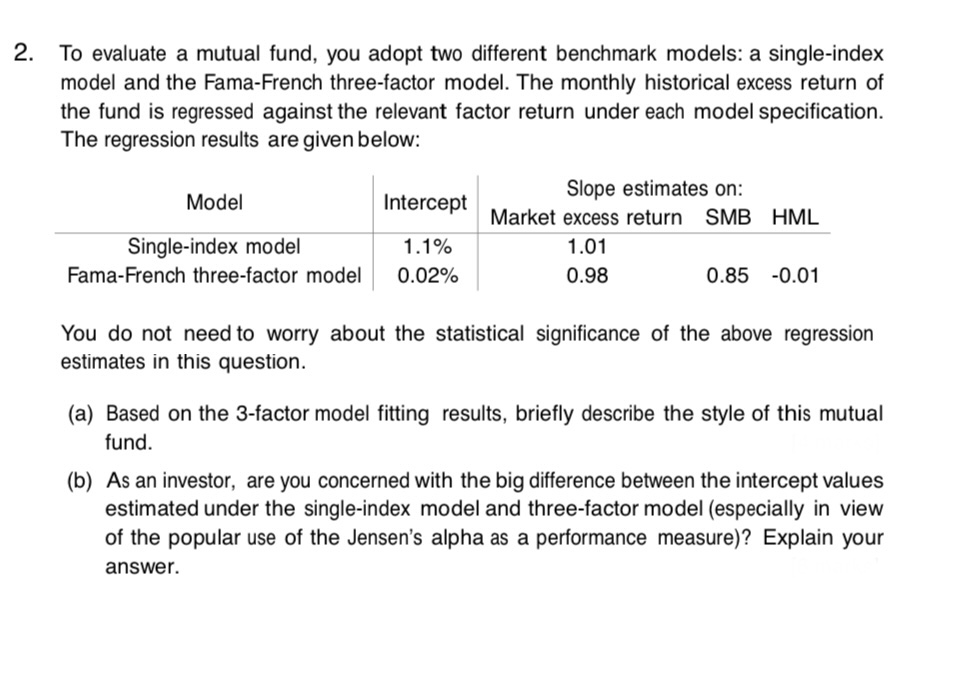

2. To evaluate a mutual fund, you adopt two different benchmark models: a single-index model and the Fama-French three-factor model. The monthly historical excess return of the fund is regressed against the relevant factor return under each model specification. The regression results are given below: Model Intercept Slope estimates on: Market excess return SMB HML Single-index model Fama-French three-factor model 1.1% 0.02% 1.01 0.98 0.85 -0.01 You do not need to worry about the statistical significance of the above regression estimates in this question. (a) Based on the 3-factor model fitting results, briefly describe the style of this mutual fund. (b) As an investor, are you concerned with the big difference between the intercept values estimated under the single-index model and three-factor model (especially in view of the popular use of the Jensen's alpha as a performance measure)? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

SOLUTION a Based on the 3factor model fitting results the style of this mutual fund can be described ... View full answer

Get step-by-step solutions from verified subject matter experts