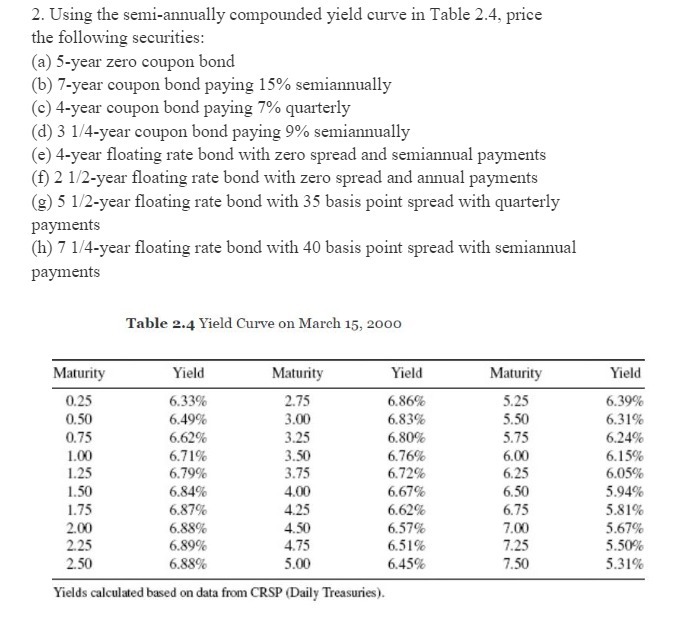

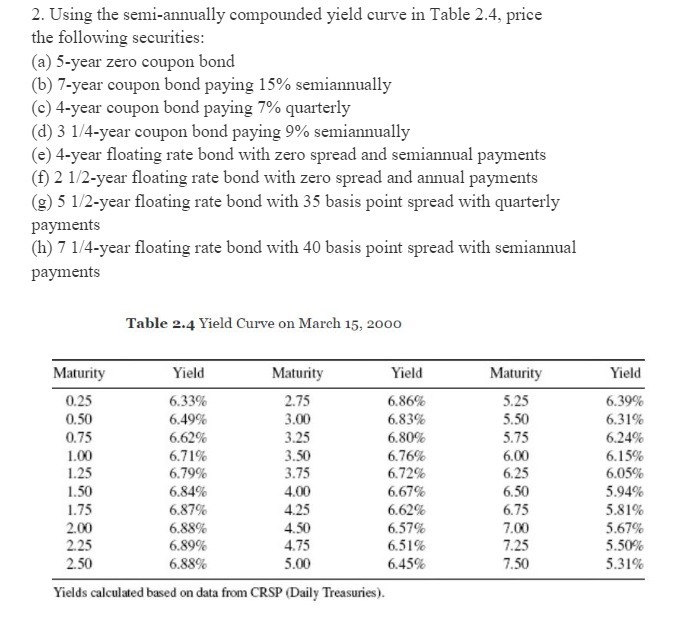

Question: 2. Using the semi-annually compounded yield curve in Table 2.4, price the following securities: (a) 5-year zero coupon bond (b) 7-year coupon bond paying 15%

2. Using the semi-annually compounded yield curve in Table 2.4, price the following securities: (a) 5-year zero coupon bond (b) 7-year coupon bond paying 15% semiannually (c) 4-year coupon bond paying 7% quarterly (d) 3 1/4-year coupon bond paying 9% semiannually (e) 4-year floating rate bond with zero spread and semiannual payments (f) 2 1/2-year floating rate bond with zero spread and annual payments (g) 5 1/2-year floating rate bond with 35 basis point spread with quarterly payments (h) 7 1/4-year floating rate bond with 40 basis point spread with semiannual payments Table 2.4 Yield Curve on March 15, 2000 Maturity Yield Maturity Yield Maturity Yield 0.25 6.33% 2.75 6.86% 5.25 6.39% 0.50 6.49% 3.00 6.83% 5.50 6.31% 0.75 6.62% 3.25 6.80% 5.75 6.24% 1.00 6.71% 3.50 6.76% 6.00 6.15% 1.25 6.79% 3.75 6.72% 6.25 6.05% 1.50 6.84% 4.00 6.67% 6.50 5.94% 1.75 6.87% 4.25 6.62% 6.75 5.81% 2.00 6.88% 4.50 6.57% 7.00 5.67% 2.25 6.89% 4.75 6.51% 7.25 5.50% 2.50 6.88% 5.00 6.45% 7.50 5.31% Yields calculated based on data from CRSP (Daily Treasuries)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts